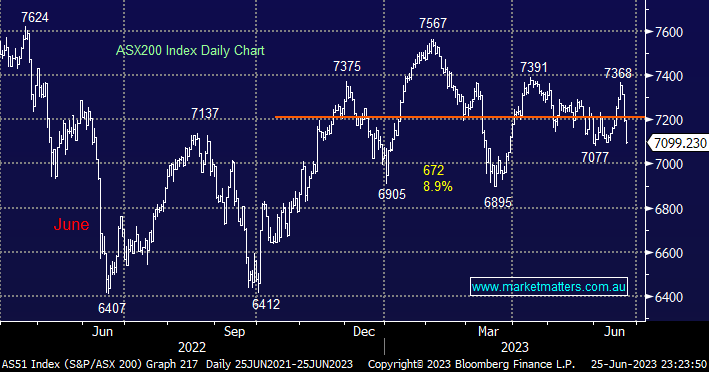

The ASX200 was sold off aggressively last week and we believe there’s a strong possibility that the selling could follow through over the coming weeks – if we look at the move in June 2022 the decline may have only just begun! Just because stocks fell last June is not a reason for MM to adopt a selling approach to stocks but when combined with the weakening economic data that’s surfaced over recent weeks it does combine to make us adopt a cautious short-term approach.

- The SPI Futures are pointing to a -0.2% dip this morning, not helped by a -0.5% drop by BHP in the US.

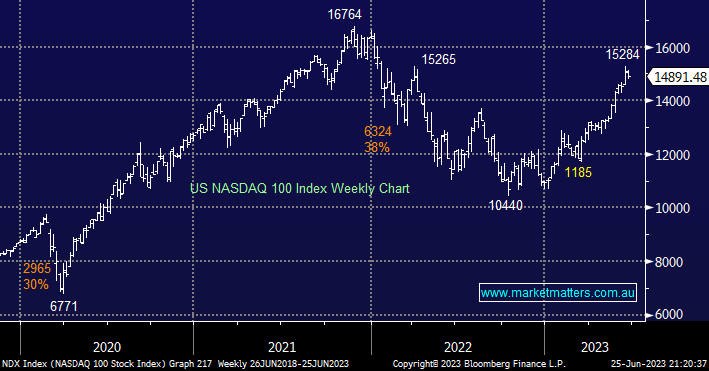

The tech based NASDAQ has retreated marginally from its 2023 highs but it’s hardly a speedbump compared to the decline by the ASX into the weekend. While heavyweights such as Microsoft and Apple Inc continue to make fresh all-time highs we believe it’s a very dangerous game to call the US growth stocks lower i.e. far better risk/reward is delivered by buying pullbacks with the bullish trend.

- No change, we are keen buyers into weakness, ideally of a similar magnitude to the February-March pullback.

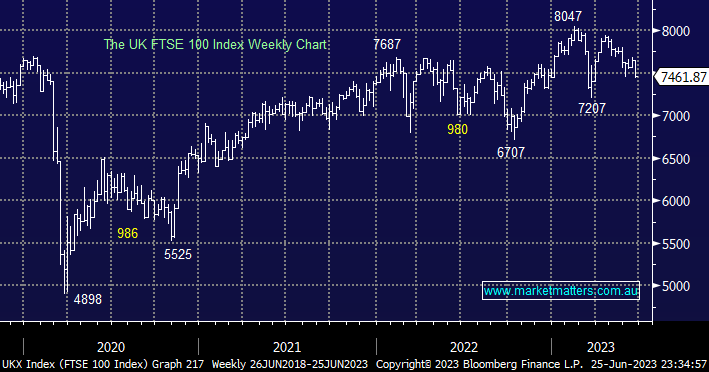

The UK FTSE is looking very similar to the ASX which is not encouraging for the bulls but for investors like ourselves who are holding decent cash levels and looking to accumulate stocks into weakness, it’s ideal, especially when we have some highly correlated resource stocks in our Hitlist.

- The advance by the FTSE above 8000 is starting to look & feel increasingly like a “false breakout” which suggests the next 5-10% is down.