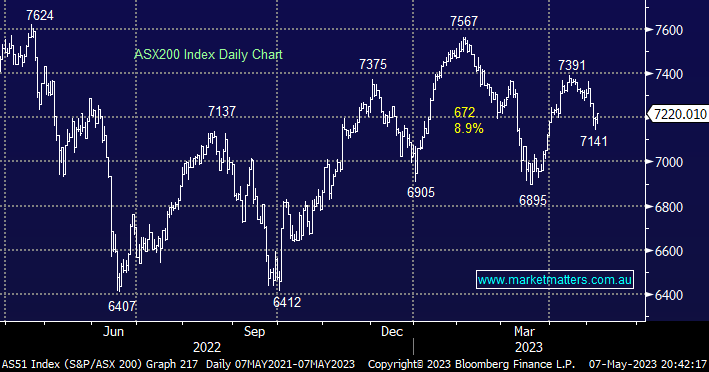

The ASX200 reacted badly to the “surprise” RBA rate hike but after a rapid 250-point drop buyers returned albeit in very specific pockets of the market e.g. ESG and gold names. The markets experienced a rollercoaster ride of sentiment over the last 2-year yet the markets remained largely range bound between 6500 and 7600, in this case we believe it’s a case of if it’s not broken don’t fix it i.e. de-risk in the 7400-7600 area and increase market exposure/risk below 6750.

- No change, we believe this year will be about “buy weakness and sell strength, with an emphasis on the latter” while stock & sector rotation will provide plenty of opportunities under the hood.

- In the very short term we can see the local index squeezing higher led by a bounce in the banks and ongoing strength across tech but we wouldn’t chase either.

Following strong gains on Wall Street on Friday the local index is set to open up around 60 points, aided by a $US1 advance by BHP in the US.

US stocks rallied strongly on Friday night as regional banks finally managed to bounce after falling a painful -20% into Thursday, this combined with Apple Inc (AAPL US) +4.7% helping the NASDAQ to its best close since August 2022 resulted in strong gains across the major US indices e.g. S&P500 +1.85%. With US earnings coming in ok and central bank meetings now in the rear-view mirror we wouldn’t be surprised if the worst of May is already behind us.

- No change, we continue to target the 13,750 for the NASDAQ, now only 3-4% away but it’s not an advance we would chase.

European stocks bounced strongly in the 2nd half of last week and the FTSE again looks poised to test its 2023 highs as the market continues to absorb bad news such as rising rates and global banking woes.

- No change, the UK FTSE looks set to test the 8000 area in the coming months i.e. only 3% away from Friday’s close.