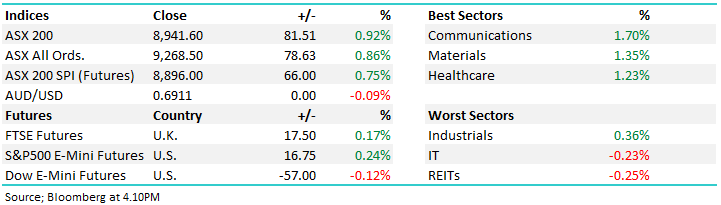

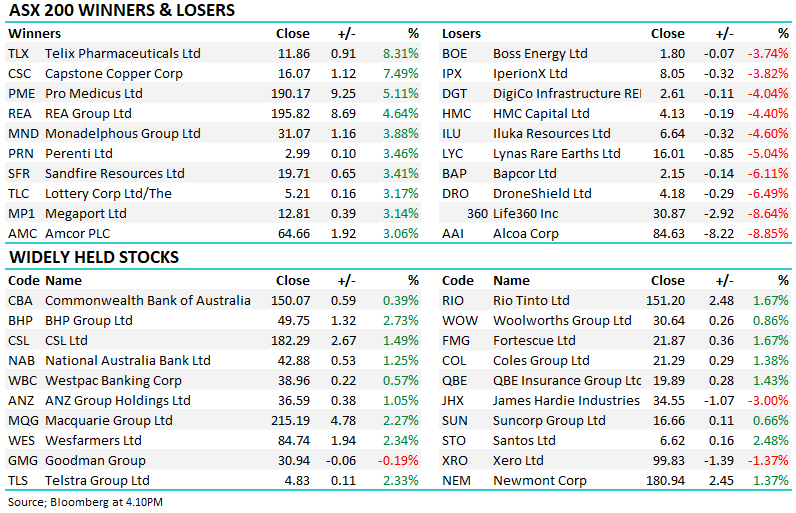

The ASX200 surged higher on the 1stday of December as it celebrated Jerome Powell’s first meaningfully dovish comments of 2022, the result on the stock level was very much as expected with interest rate sensitive names finally hogging the limelight e.g. four stocks held at MM soared higher, Evolution Mining (EVN) +6.3%, Xero (XRO) +6.2%, James Hardie (JHX) +5.4% and Sandfire (SFR) +5.2%. We have been positioned for such a move for over a month so let’s hope it’s not a “one and done” knee-jerk rally following the Fed Chairs speech.

• “The time for moderating the pace of rate increases may come as soon as the December meeting” – Jerome Powell, Chair of the Fed Reserve.

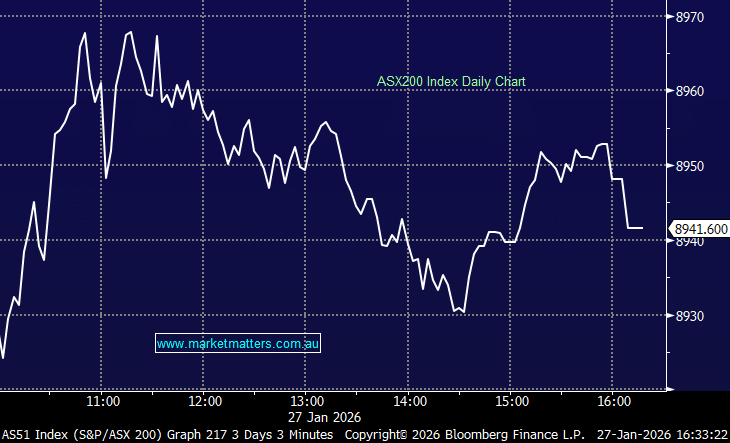

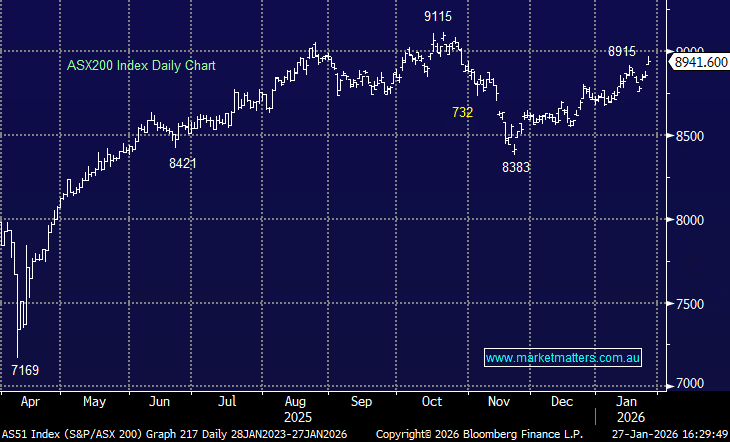

The gains were broad-based across the market with over 75% of the main board closing in positive territory, only the Energy & Healthcare Sectors closed down on the day which saw the ASX200 trade within 3.6% of its all-time high posted in August of 2021 – what bear market! The defensives are not surprisingly the main area dragging the chain which could provide MM with some excellent switching opportunities when we feel its time to migrate back down the risk curve: