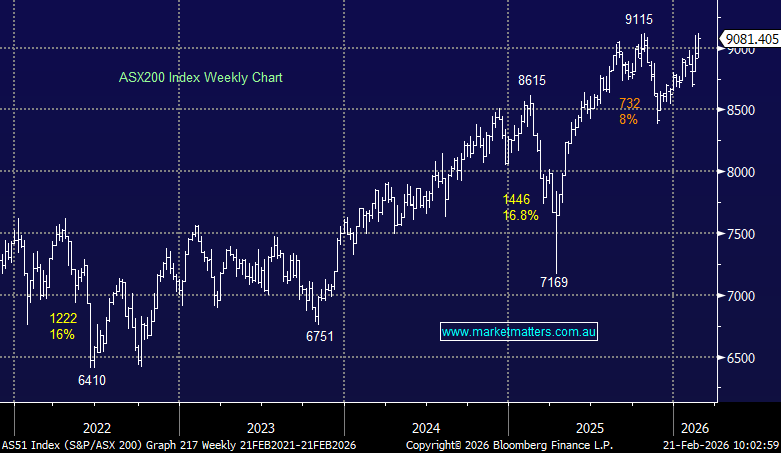

The ASX200 fell another -0.5% yesterday after trading higher in the morning only to be buffeted lower following comments from the Whitehouse which threw cold water on any potential currency intervention to cap the rising $US plus Apple (AAPL US) announced it had shelved plans to increase iPhone production due to faltering demand, the 2 pieces of news sent US Futures sharply lower, dragging the SPI and local stocks down in its wake. There’s no doubt that at the moment the Fed and most fellow central banks have little concern about the negative impact of their rhetoric on stocks. As we said on Wednesday morning “further news-driven turbulence feels…