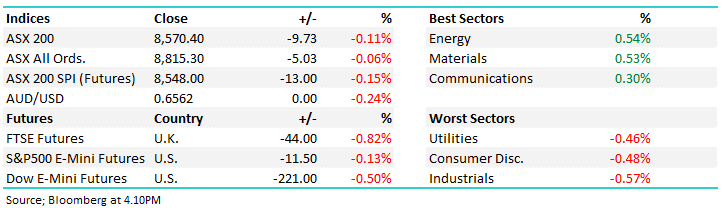

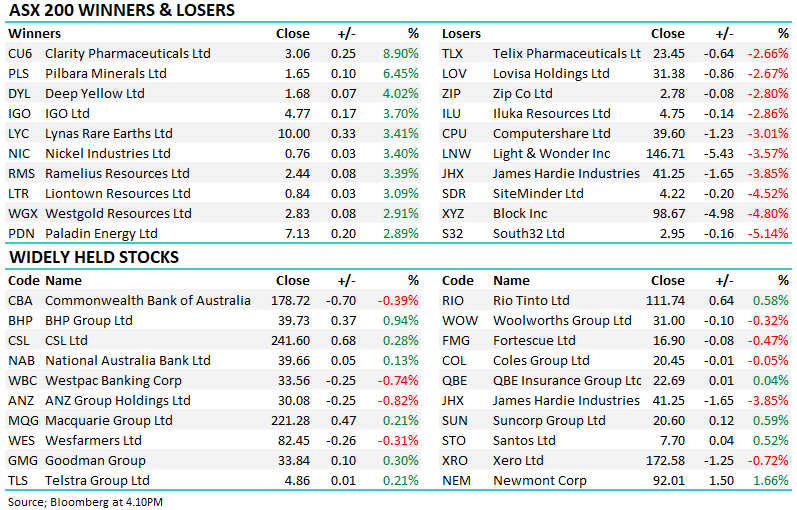

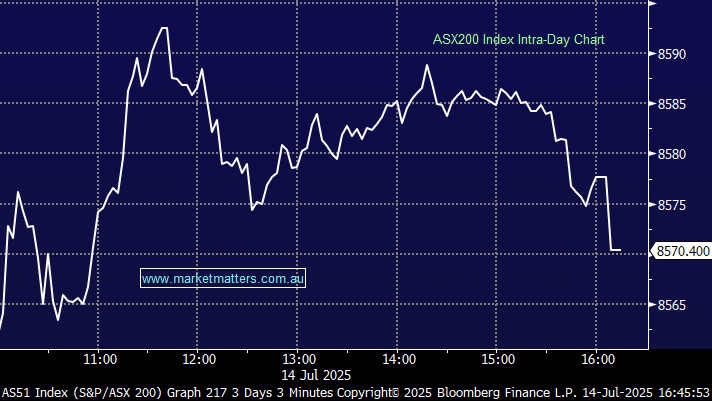

The Match Out: Banks drag ASX lower, tech stocks take hit on U.S Open Banking shake-up

Energy & Resources led the charge today with BHP back knocking on the door of $40, and is now up more than 8% in FY26 relative to Comm Bank (CBA) which has fallen ~3%.