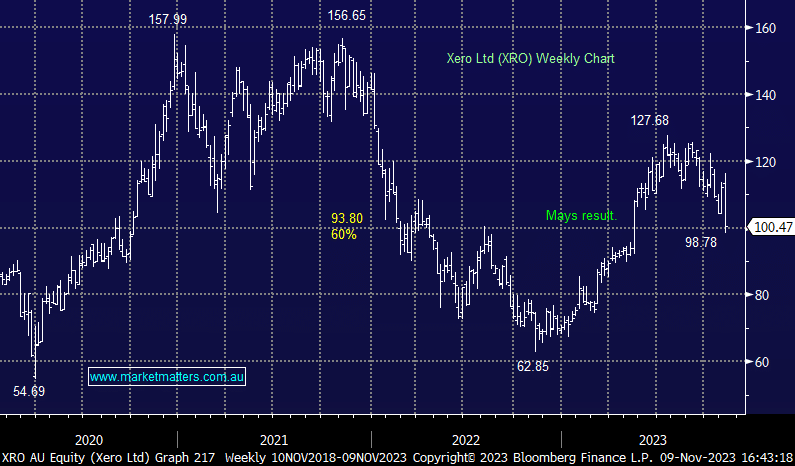

XRO -12.42%: accounting software company fell more than 10% today for the first time in 2 years on a small miss at the 1H result. The good news was a great core Australia & NZ result with a combined 139k subs added and a small revenue beat. Average Revenue Per User (ARPU) was a small beat but this looked to be carried by an FX tailwind. Free Cash Flow (FCF) at $NZ107m was a big beat to consensus at $NZ49m, though this was driven by lower capex in the period as shown by the ~5% EBITDA miss. The company maintained FY24 guidance for 75% operating expenses to revenue, though we suspect the market was looking for an upgrade here given the focus on costs at the FY23 result in May. They talked to an improved strategy around the US market which will be key to growth longer term but may case some short term pain.

- A small miss, even with the help of FX, XRO was dealt with harshly by the market