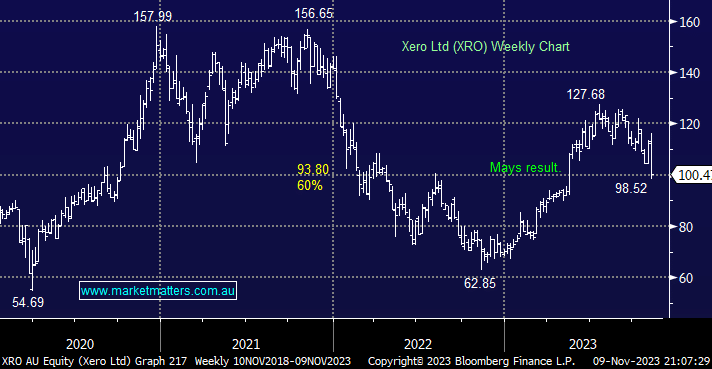

What a difference a result makes! In May, the stock soared after its result, demonstrating solid earnings from the accounting platform and good progress as they worked towards balancing growth and profitability. However, yesterday saw the stock plunge the most in 2-years after a small miss with its 1H result. The company maintained FY24 guidance for 75% operating expenses to revenue, but the reaction by XRO implied investors were expecting an upgrade. Subscriber growth came in slightly lower than expectations as they raised prices; hence, growth expectations were tweaked lower, i.e. the risks when a stock is trading on such a high valuation. The price action felt highly overdone, but 2023 has rarely been a year to fight the tape.

- We will watch XRO carefully this morning after the markets have had time to digest its results further; we are conscious of how WiseTech kept falling after their disappointing result – MM holds XRO in our Active Growth Portfolio.