- Markets @ Midday: Listen here at lunchtime or find all Market Matters Podcasts on Spotify.

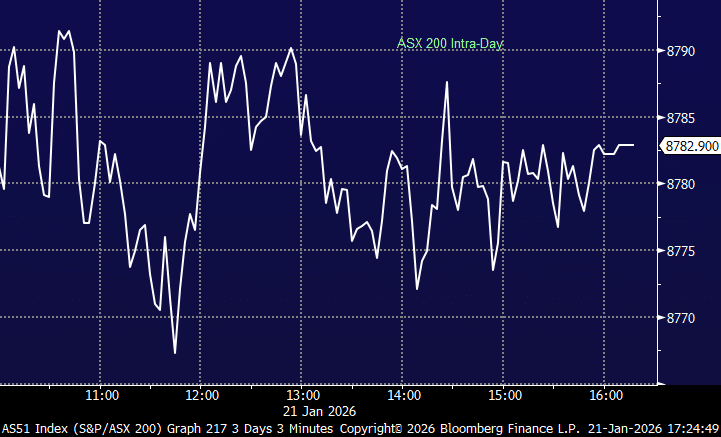

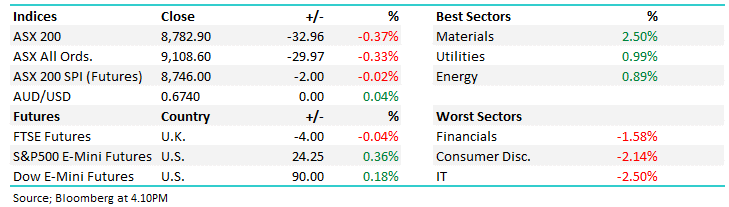

The ASX fell for a third consecutive session, although strength in some pockets (resources) was enough to only see modest declines at the index level. Tech and banks the major drags, while Gold rallied another $US100/oz to hit yet another record high at $US4871/oz – so much for it being a crowded trade!

- The ASX200 fell-32pts/-0.37% to close at 8792

- Materials (+2.5%), Utilities (+0.99%) and Energy (+0.89%) led the line.

- Tech (-2.5%), Consumer Discretionary (-2.14%) and Financials (-1.58%) the weakest links.

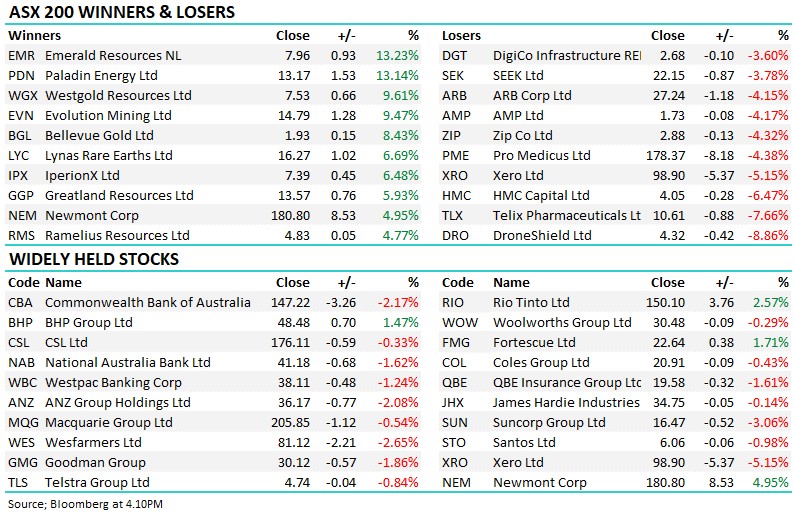

- BHP Group (BHP) +1.5%, now within ~$1bn of CBA’s market cap – Comm Bank (CBA) -2.17% down again

- Rio Tinto (RIO) +2.6% after record Pilbara iron ore production.

- Newmont (NEM) +5.0% as gold pushed above US$4,800/oz.

- Evolution Mining (EVN) +9.5% and Westgold Resources (WGX) +9.6% on strong quarterly results.

- Paladin Energy (PDN) +13.1% rallied nicely after guiding full-year uranium production towards the top end of guidance. They are finally getting it right operationally.

- Lynas Rare Earths (LYC) +6.7% as realised rare earth prices jumped sharply quarter-on-quarter.

- Telix Pharmaceuticals (TLX) –7.7% after FY25 revenue landed at the bottom end of guidance.

- James Hardie (JHX) –0.14% lower despite Jefferies seeing 2026 as a “turnaround year” as US housing sentiment starts to pick up on mortgage rate compression, improved affordability and turnover.

- Gold rallied $US100/oz and was trading at US$4871/oz around our close, equates to A$7228/oz!

- Iron ore was mildly lower, trading $US103.50/mt

- Asian markets were mixed, with China up 0.47%, Hong Kong was flat and Japan fell -1.2%

- US futures are trading up +0.4%