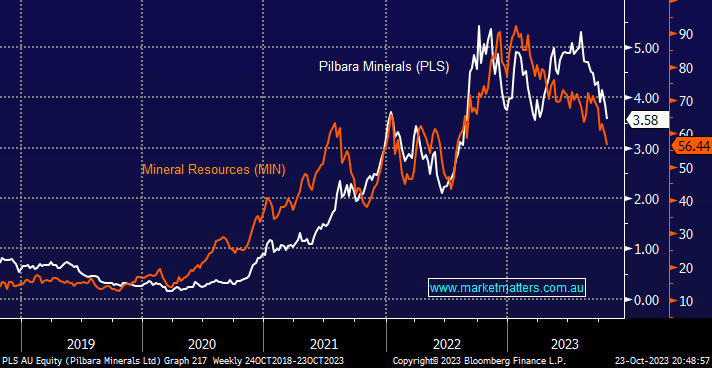

After weeks of deliberation, we added to our Mineral Resources (MIN) position yesterday, catching the proverbial falling knife with the stock down over -40% from its 2023 high. We have been planning/flagging this move since the lithium sector started falling, but as we’ve said repeatedly, “it just didn’t feel right.”- I can imagine a few readers thinking how did yesterday feel right, with Pilbara Minerals (PLS) -7.3%, but it was the panic which saw us make the move.

- Lithium has become extremely volatile in 2023, but the countless bulls (analysts) have now turned bearish – Pilbara (PLS) has fallen -34% since July.

- We prefer MIN’s iron ore & lithium mix to pure lithium, a fairly new industry with plenty of uncertainties in its journey as EVs take an increasing grip on the roads.

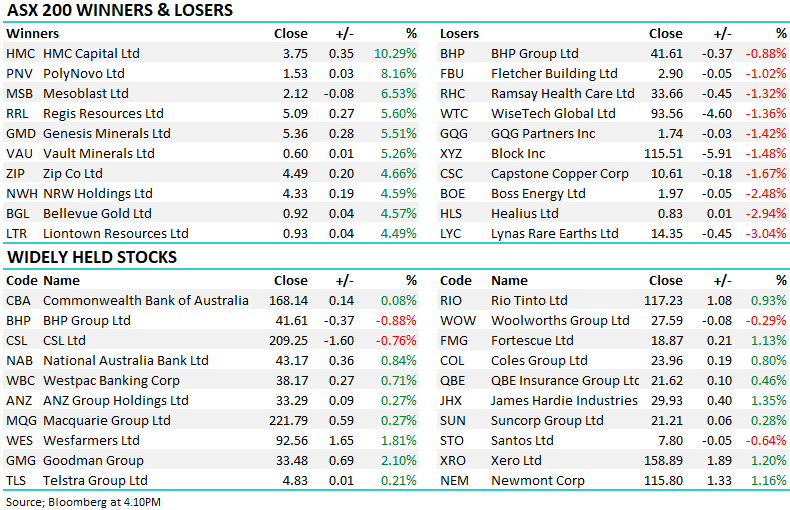

Our Active Growth Portfolio now holds 8% in BHP Group (BHP) and 5% in Mineral Resources (MIN), which enjoyed 40% of its revenue from lithium in FY23, i.e. we haven’t gone “all in” towards either iron ore &/or lithium.