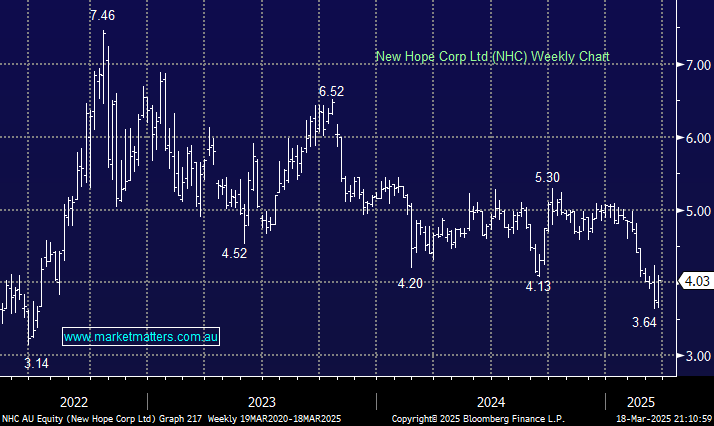

The primarily Thermal Coal producer released 1H25 results yesterday and rallied ~9%, though the stock is coming off a very low base. The result was solid, reconfirming our investment thesis on NHC as an attractive income investment with likely growth over the coming years. While NHC is not a typical defensive income stock, with earnings influenced heavily by commodity prices, we like it because it fits our small allocation to more volatile, cyclical earnings that can turn up the dial on the portfolio’s returns. We think NHC and other coal companies are on the cusp of turning around in line with a more favourable backdrop for the underlying commodity price.

Yesterday’s result by NHC surprised materially on earnings and announced substantial capital returns to shareholders.

- Revenue of $1.02bn, in line with consensus.

- Net profit of $340.3 million, +35% yoy, versus a consensus of $221m.

- They announced a buyback of $100m.

- Interim dividend of 19cps vs. 17cps yoy, putting it on a yield over 10%.

The jump in earnings was due to cost control and production growth, with output one-third higher than the same period last year. This was achieved despite a falling coal price, as NHC recorded an average sale price of $173 a tonne vs. $197 a tonne a year earlier.

- We continue to see supply/demand imbalances build in the coming years, which will eventually bode well for coal prices, earnings, and thus dividends.