NHC focuses on supplying thermal coal, unlike WHC & BTU, with an annual production expected to grow from approximately 8.7 million metric tons in 2024 to around 13 million metric tons by 2028. Additionally, NHC holds a 20% interest in the Malabar-Maxwell coking coal mine, which began operations in 2023. NHC reported well in September, and with its dividend heading in the right direction, we continue to like this as a yield play, expecting a yield of over 10% fully franked.

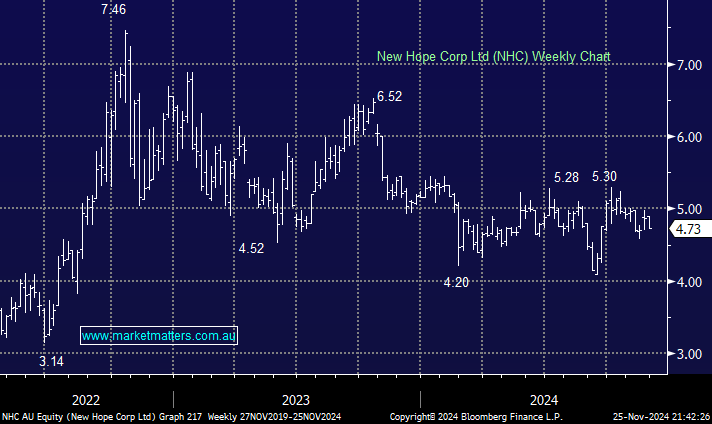

- We doubt NHC will show much capital growth given their aggressive dividend policy, and we expect a range-bound share price with dividends the main source of return. MM is long NHC in our Active Income Portfolio.