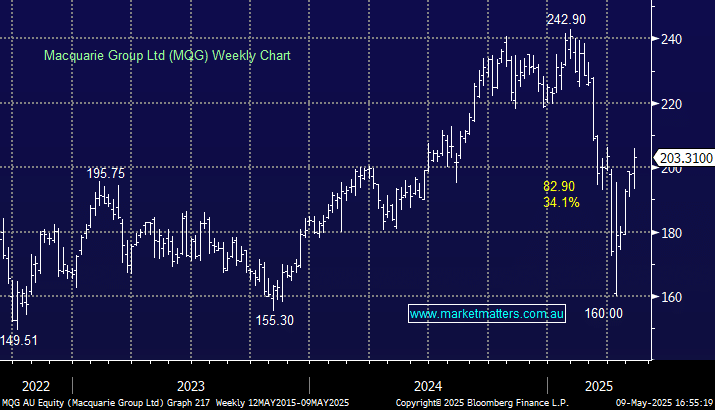

MQG +3.79%: impressed with FY25 results this morning highlighting strong asset management fees which offset weakness in its commodities and global markets business.

- Revenue +1.95% y/y to $17.2 billion, consensus $17.2 billion

- Net profit after tax +5.5% to $5.7 billion, consensus $3.7 billion

- Final dividend of $6.50, +1.6% y/y

Looking ahead to FY26E, the market is pricing in 14% earnings growth with the business expecting a recovery in the commodities and global markets division. Gains from the sale of the public markets segment of the Macquarie Asset Management business are expected to drive some of this growth as proceeds are allocated, specifically the additional capital will help with the balance sheet as they continue investment in green initiatives.