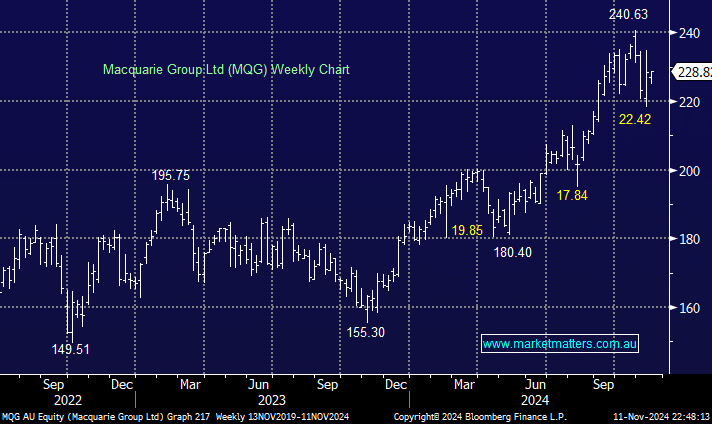

MQG is ideally positioned for lower regulation, lower taxes and a higher $US environment. Recently there have been some short-term headwinds in their commodities trading business which we believe provides opportunity, while the asset management business remains extremely strong. Earlier this month the aforementioned commodities division led to a slightly disappointing result with subdued volatility weighing on commodities and global markets activity – volatility has picked up since Trump’s victory. However, the “millionaires factory” did flag 2025 as a bumper year for deal activity which fits right into the Trump environment.

Investors and analysts alike are extremely scared of the high-valuation banks with CBA trading through $150 on Monday but we believe investment bank MQG is a great way for sector exposure following its share price dip and looming tailwind courtesy of Trump, it’s actually now on the cheaper side compared to many global names. US peers such as Goldman Sachs (GS US) and JP Morgan (JPM US) have soared to fresh highs post the election and we believe MQG will follows suit aided by around 45% of its revenue being generated in the US; Note the stock traded ex-dividend $2.60 (35% franked) on Monday.

- We recently purchased MQG for Active Growth portfolio, initially targeting the $250 area.