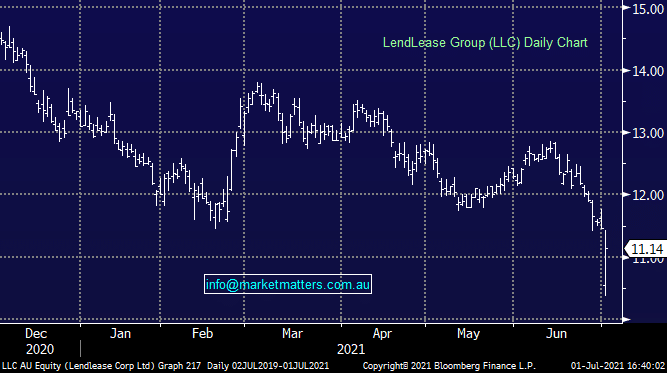

LLC -2.79%: The second year in a row LLC has put through a downgrade, this year they blame the Covid situation, particularly the impact on their UK business while they also increased their provisioning for claims relating to their now jettisoned Engineering business. For FY21, the market was looking for core earnings of $469m, however there was a big range in the market and now LLC say this will be $375-$410m. The stock was down sharply early ~8% before recovering to close down just 2.6%. The market is more focussed on what happens in FY22/23 and beyond and the downgrade today was not ‘that much’ of a surprise given the new CEO Tony Lombardo has just taken the reins. A clearing of the decks and better times ahead for LLC would be the optimistic take with more details provided at their full year results in August. We originally bought LLC on valuation grounds and exposure to infrastructure development, those factors remain however so to do risks around earnings.

scroll

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Question asked

Buy Hold Sell: The best and worst performers of FY25

Buy Hold Sell: The best and worst performers of FY25

Close

Close

Wednesday 2nd July – Dow +400pts, SPI up +18pts

Wednesday 2nd July – Dow +400pts, SPI up +18pts

Close

Close

Tuesday 1st July – ASX +10pts, HMC, IFL, SGH

Tuesday 1st July – ASX +10pts, HMC, IFL, SGH

Close

Close

We will hold our LLC position for now, however it’s on close watch

Add To Hit List

Related Q&A

Review of LLC position

LLC Director Purchases / Reaction to Results

How much further can real estate stocks appreciate?

REITS

Macquarie substantial shareholder announcements

Any thoughts on Janus Henderson (JHG)?

MM’s views on APA, LLC and GMG please

What Hybrids does MM like today?

What does MM think of CNI, CLW & LLC into current weakness?

Is Lend Lease (LLC) a takeover target?

Updated thoughts on Lend Lease

Thoughts on BHP, RIO & FMG

Relevant suggested news and content from the site

Video

WATCH

Buy Hold Sell: The best and worst performers of FY25

James Gerrish & Henry Jennings

Podcast

LISTEN

Wednesday 2nd July – Dow +400pts, SPI up +18pts

Daily Podcast Direct from the Desk

Podcast

LISTEN

Tuesday 1st July – ASX +10pts, HMC, IFL, SGH

Daily Podcast Direct from the Desk

Members only

UNLOCK MARKET MATTERS NOW

Take a free trial.

No payment details required.