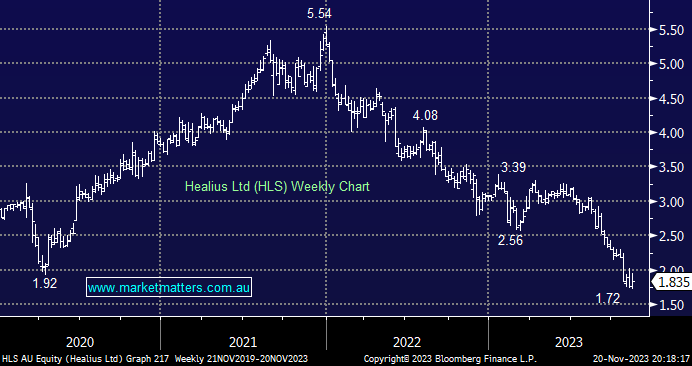

HLS is looking to raise $187mn through a rights issue at $1.20, a steep 34.6% discount to the stock’s last trade on Friday – they needed the cash! The offer was on a 1-for-3.65 basis, with the freshly listed equity looking to list under a separate ticker code as its suitor, Australian Clinical Labs (ACL), still has its scrip-only offer open. Another example of questionable consideration for shareholders by the board with HLS having been in play for years, e.g. the board rejected Jangho Group’s $3.25 bid in 2019, saying it was “opportunistic and undervalued the business” in 2020 it rejected a $3.40 takeover offer from private equity group Partners Group saying that “the board of Healius unanimously rejects the proposal on the basis that it doesn’t reflect the fundamental value of the company” however at $1.20, I doubt many loyal shareholders would agree.

- We can see HLS holding above the $1.20 issue price, but it’s a big raise for a company with a market cap of only $968mn on Friday. That said, the raise will take away a lot of the balance sheet risk which has been a major issue for them in recent years.