GMG is a major industrial/property group with a growing digital infrastructure footprint, including data-centre (DC) development and power capacity for hyperscale facilities. GMG is different in the data-centre space because it approaches it as a property developer and owner, not a pure data-centre operator like NEXTDC. Goodman mainly develops, owns and leases data-centre real estate, while specialist operators run the facilities and sell colocation services, i.e. NXT, by contrast, operates the data centres itself.

- Goodman earns property rents and development returns, whereas NEXTDC earns recurring colocation and power-based service revenue.

- Typically, Goodman is looking to work with hyperscalers and large tenants on build-to-suit or wholesale projects; NEXTDC serves a broader mix of enterprises, cloud providers and networks.

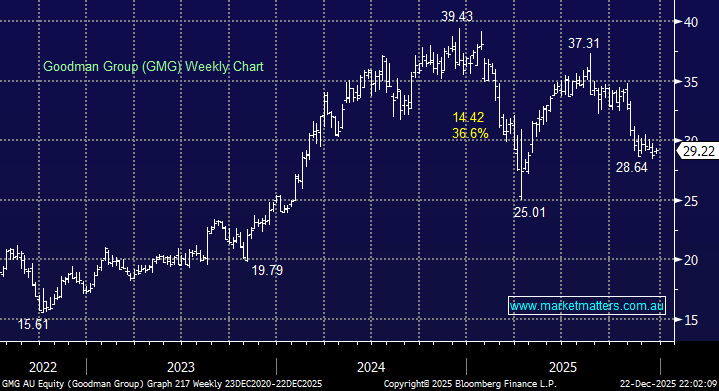

We regard GMG’s risk as lower than say NXT, as their exposure is more property and capital-deployment driven, while NEXTDC carries operational, power and utilisation risk. In other words, GMG is sticking to what it does best with a twist towards DCs. However, GMG has been caught up in the re-rating of the tech/DC stocks, which we believe is offering investors an excellent entry opportunity – GMG is a quality business trading more than 10% below its 5-year average valuation, even with the market and real estate sector having advanced through 2026.

However, GMG did raise $4bn at $33.50 in February, for DC expansion, which has left many investors carrying paper losses through the last 6-months. In November, GMG reaffirmed guidance while Greg Goodman highlighted that DCs are capex-heavy, capital-intensive, execution-critical infrastructure, but he’s a quality operator who we believe will execute very well. The GMG model is to secure power, develop prime sites in key global cities, bring in pension + sovereign wealth partners, hand over to hyperscalers and move on to the next one. Repeat for decades, sounds so simple!

- We can see GMG coming back into favour through 2026/7: MM owns GMG in its Active Growth Portfolio.