Global yields are following the MM roadmap, what do we think lies in store for stocks?

Most investors are far better buyers than sellers, no great surprise as we are all wired to be emotionally dominated by “Fear & Greed”. However common sense tells us that selling is every bit as important as buying as it plays an equal role in our alternatives at any one time i.e. buy, sell or simply do nothing. At MM we are committed believers in the stock market which by definition means we will usually be carrying a large exposure to stocks hence to add value to our portfolios we will often be switching between companies which necessitates selling, something many investors can often talk themselves out of!

In yesterday’s PM report we mentioned some stocks which managed to rally even as equities found themselves under the pump e.g. Goodman Group (GMG) +0.3%, REA Group (REA) +0.4% and Xero (XRO) +0.1%. These 3 have been stellar performers in the MM Flagship Growth Portfolio through 2023 with gains far outstripping the market i.e. GMG +17%, REA +30%, and XRO +67%. Thursday’s price action confirmed in our minds what we’ve been anticipating would unfold for months i.e. stocks that have run hard with rising rates will continue to outperform until the landscape changes – note at this stage we’re still watching the 1st part of the equation.

- We are considering switching out of XRO through July as yields make new multi-year highs.

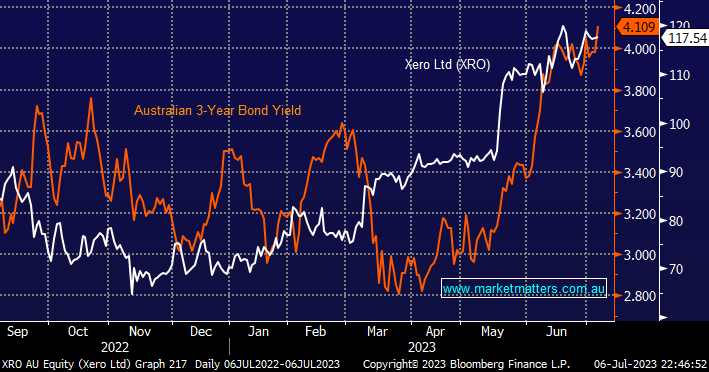

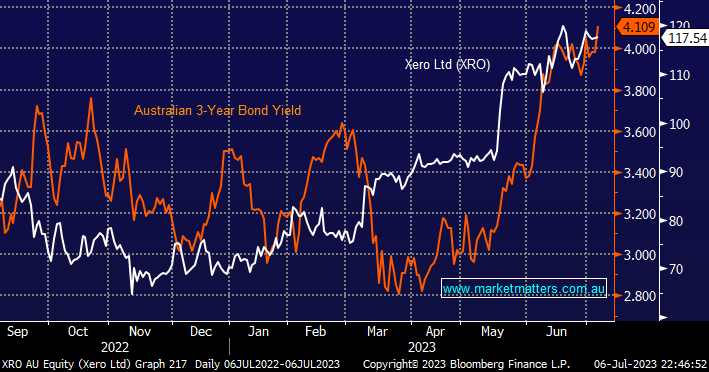

The correlation between Xero (XRO) and Australian short-dated bond yields has been strong and we believe it’s taken XRO into the fully priced domain, especially as we’re looking for yields to reverse.

Another strong performer this year mentioned above has been REA, it embraced rising bond yields which on the surface would surprise many due to its tech & property position but as subscribers know this is one trend we believe is maturing fast. It’s almost impossible, or on occasion pure luck, to buy/sell tops & bottoms hence we often scale our way in/out of positions with the same applying to an overall macro outlook on the market. At this stage of the cycle, we’ve already started slowly tweaking our portfolios towards lower rates but further moves are likely this month.

- We are considering switching out of REA through July as yields make new multi-year highs.

Similar to XRO, the correlation between REA Group (REA) and Australian short-dated bond yields has been strong and we believe it’s also taken REA into the fully priced domain.

Assuming we sell both REA and XRO in July/August the question becomes what MM wants to buy. Our focus remains predominantly in the Resources Sector which is likely to benefit when central banks start cutting rates to stave off a weakening economy. This morning we deliberately looked at 2 stocks we haven’t covered for a while to provide alternatives to previously named companies on our menu.