FMG is becoming a trickier proposition given its focus on green hydrogen production, and importantly, how much capital will be allocated towards Fortescue Future Industries. While we support companies pushing the boundaries into new areas for environmental benefit, it seems to us that Andrew Forrest’s priorities over the coming years may be focused more heavily towards ‘leaving his mark’ rather than producing strong shareholder returns from Fortescue’s Iron Ore business. While these are not mutually exclusive, it is a dynamic that we should be thinking about, particularly given our current neutrality towards the Iron Ore price.

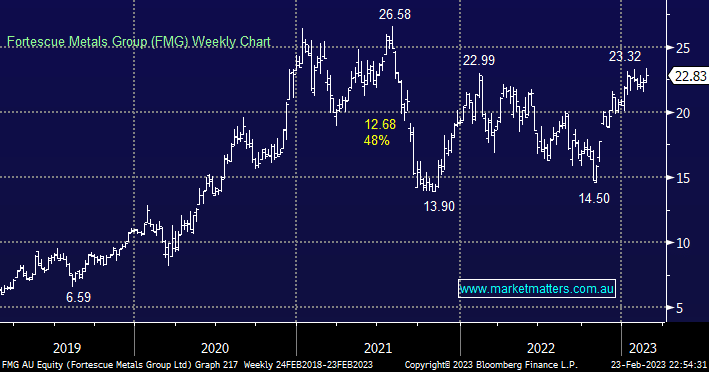

- While we believe FMG’s share price is assuming lower iron ore prices, we think there are too many unknowns to comfortably invest in FMG after its ~60% rally in 4 months.