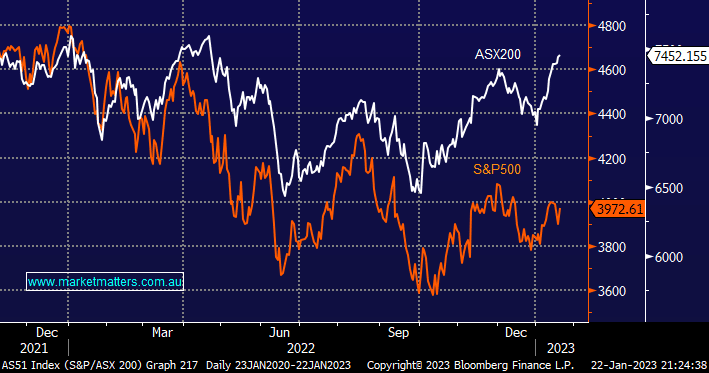

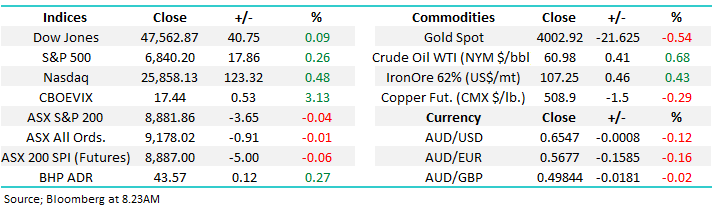

Australian stocks continue to defy gravity and overall investor sentiment, this morning they look set to open less than 2% below last year’s all-time high even while interest rates soar, housing prices fall and US stocks struggle i.e. the S&P500 closed higher on Friday but still a painful 21% below its last 2021 top. It’s not just the obvious miners that are dragging the ASX higher the banks remain very strong with heavyweight CBA less than 1.5% below its top before we even consider its excellent yield.

- Since stocks reversed higher in Q4 of last year the ASX200 has now rallied +16.2% outperforming the S&P500 in the process.

Medium to longer term we believe the local market will continue to enjoy this recent relative strength reversing years of dominance by US equities although short-term we can see a tech-led pop by the S&P500 above its late 2022 high which is likely to be supportive of less influential pockets of the ASX200. Last week saw buying appear to enter Australian stocks whenever the $A dipped suggesting overseas investors were accumulating local stocks into weakness which supports our medium-term bullish view towards resources in particular.

- Historically the ASX200 usually tracks the UK FTSE closely, and 2023 has been no different with the European index already making fresh 5-year highs, testing its 2018 all-time high in the process.

January’s Bank of America Fund (BofA) Managers Survey showed that even while growth optimism has improved allocations to US equities are at their lowest levels since 2005. However, they have flipped bullish on European equities moving overweight the region while they continue to buy Emerging market stocks. Recession fears are diminishing with China reopening one of the main drivers of an outlook that has helped drive the ASX200 Resources Sector higher.