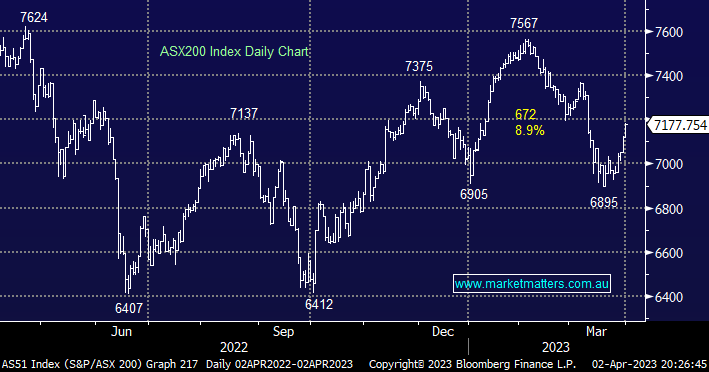

Following a stellar final 5-days to the month the ASX200 ended down just -1.1% for March, an impressive performance considering the volatility and uncertainty that swept through the banking sector as investors realised how many paper losses many large institutions were carrying on their books having bought Treasuries post COVID when they were yielding almost zero. If it hadn’t been for a -5.3% drop in the Energy Sector and -3.6% in the Financials it would have been a great start to 2023.

- With the “Banking Crisis” apparently in the rear-view mirror the interpretation of inflation and economic strength is likely to lead equities through 2023

- The local market is set to open up +0.8% this morning, back above the psychological 7200 level following strength across US indices on Friday night.

US stocks rallied again on Friday with the tech-based NASDAQ gaining another +1.7% taking it to levels not enjoyed for over 6 months, this illustrates the influence of interest rates on growth indices although not all stocks are equal as we mentioned earlier. Noticeably so far in 2023, the NASDAQ has rallied +20.5% while the Russell 2000 small cap index has gained only +2.3% weighed down by weakness across the Regional Banking Sector.

- No change, in our opinion the US NASDAQ 100 can rally towards 13,700 over the coming weeks, now only 4% away.

European stocks rallied last week even as banking fears continued to percolate in the background, as we so often say MM likes markets that can rally on bad news and we see no reason to fight this bullish move in early April.

- No major change, the EURO STOXX is positioned strongly to make a fresh post-COVID high even following the problems at Credit Suisse.