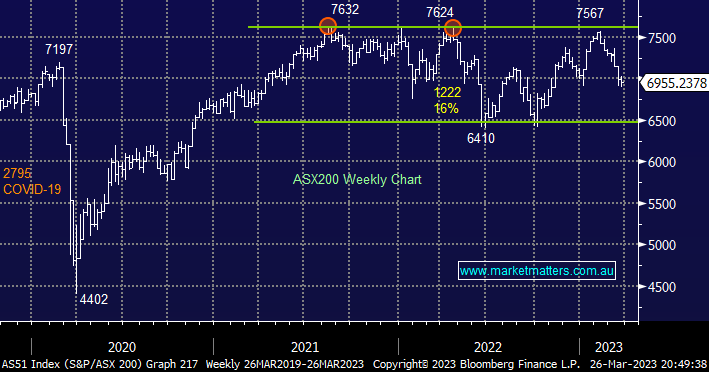

The ASX200 is down over 300 points in March having already wiped out all of the impressive gains in January and early February, investors now find themselves becoming increasingly nervous toward 2023. At the moment we have a stock market focusing on an unstable banking sector and a looming recession which by definition is weighing on the two most influential sectors in the Australian market. Medium-term we wouldn’t be surprised to see the local index remain within the confines of the last 2 years as we wait to see how well central banks can deal with the post-easy money period.

- When the banking crisis is averted we believe markets will just transfer all of their attention to how bad the looming recession may become.

- The local market is set to open basically unchanged this morning after the SPI futures focused more on European weakness as opposed to US strength on Friday night.

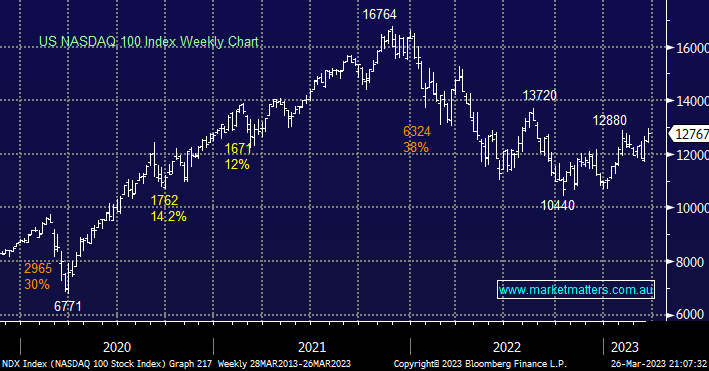

US stocks rallied again on Friday with the tech-based NASDAQ gaining +0.3% taking it within one good day of making fresh 6-month highs – as subscribers know MM is keen on markets that can rally on adverse news. The growth and especially tech stocks are embracing falling bond yields as the market becomes increasingly convinced a painful recession is just around the corner.

- No change, in our opinion the US NASDAQ 100 can weather this banking storm and rally towards 13,500 over the coming weeks/months.

European stocks rallied last week even as banking fears remained at the front of most news stories but if Europe can follow the strong US lead from Friday we could easily see the EURO STOXX challenging its high for the year, only 4.5% away.

- The EURO STOXX is positioned well to make a fresh 2023 high if Deutsche Bank can recover sooner rather than later i.e. Credit Suisse is already becoming a memory.