The ASX200 edged marginally lower last week as broad-based selling was offset by strength in the resources i.e. it’s not often that the ASX can shrug off a bad week for the banks – we can see this relative performance reversing throughout the coming week, especially after Chinas modest 5% growth target.

- We can see the local market trading between 7200 and 7400 over the coming weeks as the market weighs up the impact of central banks & China on future earnings.

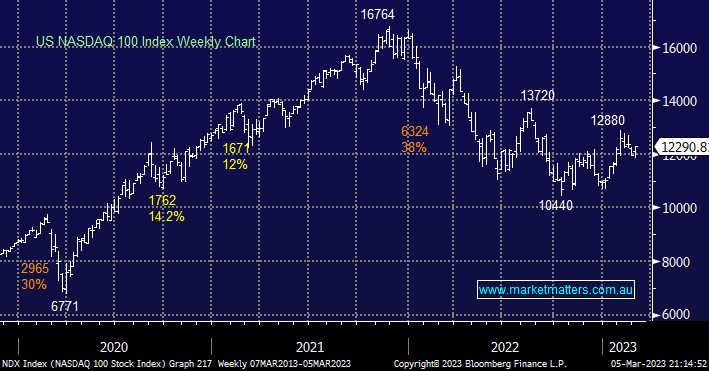

On Friday US stocks roared back to life closing on their weekly highs led by the tech stocks as US yields edged lower. After absorbing so much pressure from the Fed, we believe when bond yields just pause on the upside stocks will enjoy a relief rally – at MM we believe there’s a growing sense that the Fed is approaching the end of its tightening cycle.

- The NASDAQ 100 in our opinion remains on track to test the 13,500 area, or 8-10% higher.

European stocks remain extremely strong despite ongoing energy concerns, courtesy of the Russia-Ukraine conflict plus the much-discussed risks of a global recession through 2023/4. As we often say “don’t fight the tape” and at this stage, we believe a test of new highs ~4500 is almost inevitable.

- The EURO STOXX 50 looks on track to follow the FTSE to all-time highs over the coming months.