The ASX200 closed higher last week, although it didn’t feel like it after Friday’s 1.4% unwind, which saw over 80% of the main board close in the red – BHP accounted for around 30% of the index’s loss. At this stage, we are 50-50 as to the market’s next 150 points, which is not a common stance for MM; we are usually far more committed! We are still in “Buy Mode”, carrying reasonable cash levels, looking for optimum entry points, ideally a little lower for stocks we’ve been flagging in recent reports.

- The SPI Futures are pointing to a +0.3% advance this morning after broad-based gains in the US on Friday night – BHP closed unchanged in the US.

The US S&P500 enjoyed a solid week, gaining +2.7% as reporting season dominated the market along with some ongoing interest rate jitters, i.e. will the Fed cut once or twice in 2024, a far more dovish tailwind than that enjoyed by the ASX. However, some investors are saying the debate is shifting from when to if the Fed will cut rates; the commentary after this week’s policy meeting will be scrutinised carefully. “Big Tech” names illustrated the market’s current ability to place a stock firmly in the naughty corner if it disappoints with its earnings and/or outlook while alternatively sending it to fresh all-time highs if it beats market expectations.

- Meta Platforms (META US) ended last week down ~8%, while Alphabet (GOOGL US) surged well over +11%.

We like the risk/reward towards the S&P500 when the index dips below the psychological 5000 level, but as we enter the infamous May with ongoing interest rate uncertainties, another foray on the downside cannot be discounted.

- The US S&P500 has corrected ~5.9% from its recent all-time high; another few per cent still wouldn’t surprise.

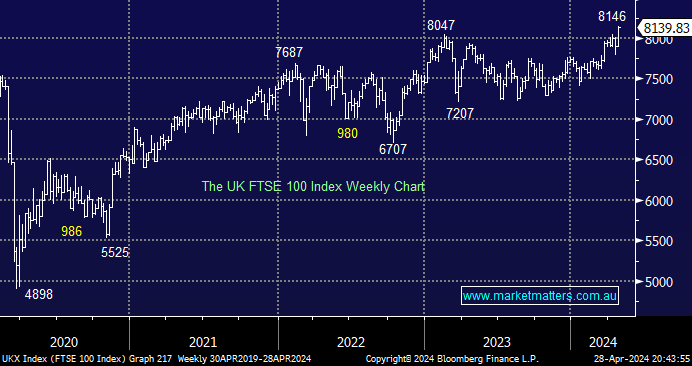

The UK FTSE again posted new all-time highs on Friday night, helped by its Materials Sector, which is almost ten times as large as its IT Sector; however, the Financial and Consumer Staples are the two largest sectors in the UK, i.e., these 3 sectors make up ~50% of the FTSE 100. In the ASX200, the same three groups are ~55% of the market; hence, they have similar characteristics compared to the tech-heavy US indices. We believe the UK FTSE will continue to outperform US stocks as the tech advance matures while the resources move is arguably just in its infancy.

- We remain bullish towards the UK FTSE, a positive read-through on the highly correlated ASX and especially the miners.