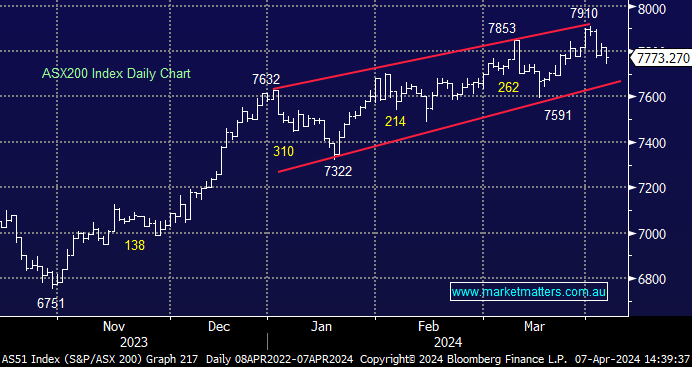

The ASX200 slipped 1.6% as it kicked off April with a shortened week. As we’ve pointed out a few times recently, every month of 2024 has delivered an average pullback of around 260 points —so far, April has produced a 169-point pullback, and it’s only one week old. Our preferred scenario is that the ASX200 will test at least the 7700 level over the coming weeks; hence, we will likely be patient before putting our slightly higher cash levels back to work.

- No change; We remain bullish on local equities, but subscribers should remember that the market’s “three-step forwards, two-step back dance” will likely continue unnerving unprepared investors.

- The SPI Futures are pointing to a solid + 0.5% advance this morning after Wall Street shrugged off robust employment data on Friday, preferring to focus on the positive ramifications for corporate America from a strong economy.

US equities experienced a very volatile start to April; they were hammered on Thursday, with the Dow closing down 530-points after Minneapolis Fed Bank President Neel Kashkari said that he pencilled in two rate cuts this year but that if inflation continues to stall, none may be required! However, on Friday, the index regained 60% of its losses as it adopted a glass-half-full attitude to an extremely strong jobs report – remember, if stocks can rally on hawkish/questionable data, it’s a strong market. The S&P500 is only 1.1% below its all-time high, and until further notice, it’s still a bull market, albeit one that feels primed for volatility and a pullback of sorts.

- We can see further upside for US stocks through 2024 as the bull market marches higher – remember, surprises usually unfold with the trend, i.e. on the upside.

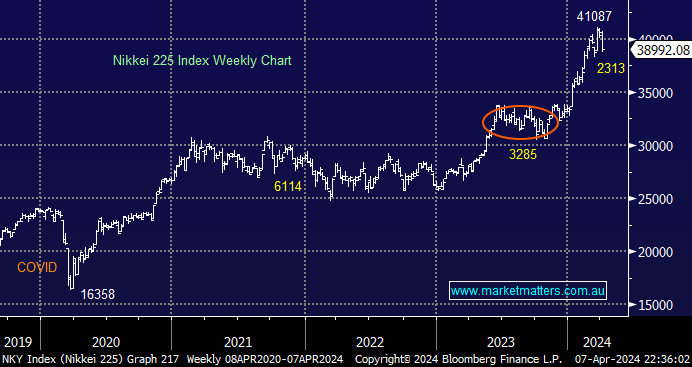

Japanese equities surged to all-time highs in March even as the Bank of Japan (BOJ) hiked rates, albeit back to the 0-0.1% target, levels Australian mortgage holders would dream of. The combination of a weak Yen, which is great for exports, and expectations that rates will remain comparatively low have been enough to propel the Nikkei ever higher, e.g. The $USJPY is testing levels not seen since 1990. While we believe another period of consolidation is unfolding similar to the one in 2023, we are still looking for another leg higher into 2025 by the Nikkei.

- We have been targeting a pullback by the high-flying Nikkei towards the 38,000 area. After last week’s sharp decline, the journey is already 70% satisfied.