The ASX200 is set to open firmly this morning, up around +0.2%, following in the footsteps of European indices as opposed to the US, which remained in holiday mode. Last week was quiet on the index level, causing many pundits to say the November rally is running out of puff. Still, we are comfortable giving equities the benefit of the doubt due to the US holiday period. However, seasonally, we remind subscribers that the “Christmas Rally” doesn’t usually gather momentum until the 2nd half of the month as significant dividends start hitting investors’ accounts.

- The SPI Futures are pointing to a higher opening this morning, up around 15 points, following a quiet post-Thanksgiving session on Wall Street.

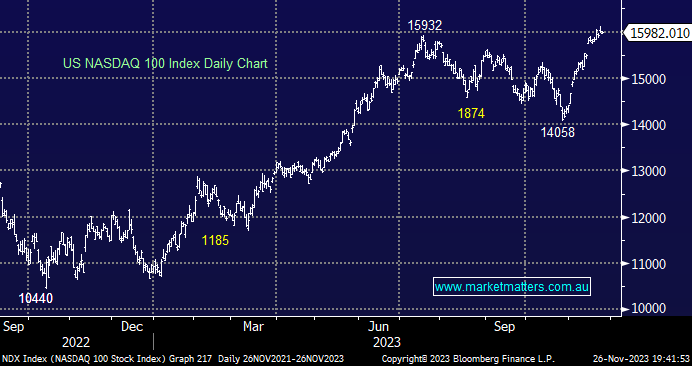

US stocks closed firmly last week, with major indices advancing for a 4th straight week, enabling November to live up to its traditional bullish tag, i.e. over the last decade, the S&P500 has advanced an average of +3.2% in November, making it the 2nd best month of the year. We believe the S&P500 has more left in the tank into Christmas; hence, the tech names are likely to follow suit, but we are now adopting a more cautious stance after being bullish throughout most of 2023 as they’ve reached our initial target area.

- No change; the FANG+ & NASDAQ Indices have followed the MM roadmap to fresh 2023 highs; hence, we are now adopting a more cautious stance to this high-flying market sector.

The US small caps have performed very strongly through November, taking solace from the retreat in bond yields; we believe this will be ongoing into 2024 and can see the Russell 2000 outperforming the highflying NASDAQ over the coming months – a major reversion call compared to the last 10-months. We are looking for the US small caps to advance an additional ~10% through Christmas, more than we envisage the NASDAQ &/or S&P500 advancing.

- We can see the Russell 2000 (small caps) testing the 2000 area into Christmas, or +10% higher.