CBA is a world-class bank, but it’s often accompanied by the unattractive tag of being the world’s most expensive – but yesterday’s result demonstrated why. There was plenty to like in CBAs report from its giant $5.4bn profit as it cemented its dominant market position by holding its market share in the home loan market at over 25% while also increasing household deposits by 26.6%. Analysts may not be fans on valuation grounds, but the bank keeps delivering while keeping well ahead of the pack on the technology and AI front. A bonus is that the stock is also likely to enjoy a “safety” bid if we see any wobbles in the ASX this year, although its sub 3% fully franked yield is on the low side, particularly when CBA bonds paying ~5.5% – CBA will pay a $2.35 fully franked dividend next week.

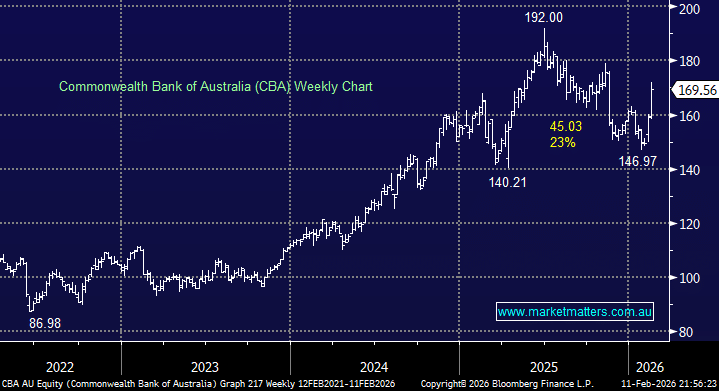

- We like the risk/reward towards CBA below $170, seeing limited downside following yesterday’s 1H result.