The CBA bears have been crowing of late and we’re glad to have exited our position in the Income Portfolio in July ~$180. CBAs recent September quarter trading update went down badly due to margin pressure despite solid profit growth and healthy lending momentum, plus of course it’s expensive. While CBA remains best-in-class operationally, margin headwinds and an uncompromising valuation leave limited room for error, yet the stock is still trading on the expensive side relative to both the sector, and its own historical norms (around 1 standard deviation above on both).

Their recent trading update confirmed the business remains strong, but it also reinforced our preference for cheaper peers like ANZ & WBC, which have more room to improve operationally. This is important in a low-growth sector, and while it comes with greater risk around execution, we are encouraged by the progress both have made under new leadership.

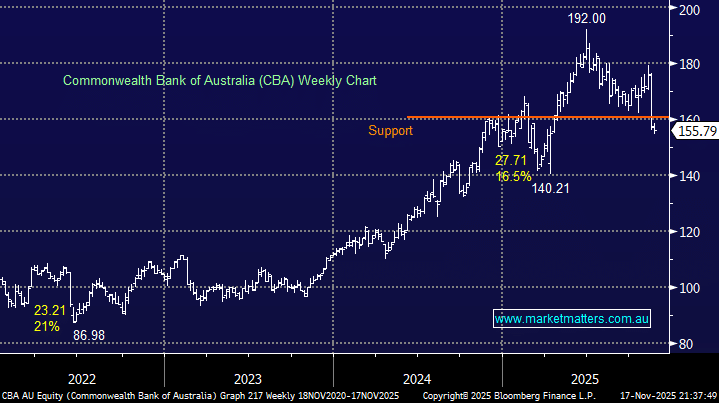

- We may consider CBA if it falls back into the $140-145 region, where some semblance of value will start to return to Australia’s largest stock.