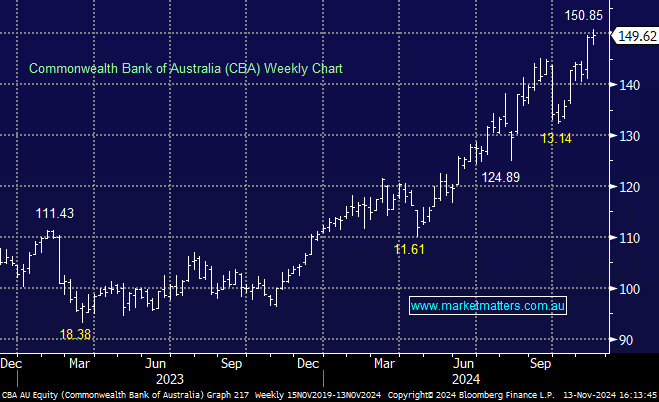

CBA –0.42%: Released its 1Q25 trading update and was ahead of consensus on key metrics but closed slightly lower on a down day for the banks amid full valuations across the sector. There were limited surprises from an earnings mix perspective with most core business functions performing as expected.

- QoQ revenue growth of 3.5%, outpacing FY24 quarters

- Cash profit of $2.5bn for the quarter -mildly ahead of expectations

- Cost growth of only 3%, driving core earnings higher

- Underlying NIM broadly stable

- Loan impairment expense of $160m below expectations – portfolio credit quality remained sound with limited new bad debt

Overall, a very solid result from CBA in line with its big 4 peers also reporting over the past few weeks. We might normally see a more positive reaction to such a result, but given the shares are up +10% in the past month, the appetite for the banks on these rich valuations might be starting to wane.

- We will stick on the side of momentum for now and continue to hold the stock in the Active Income Portfolio.