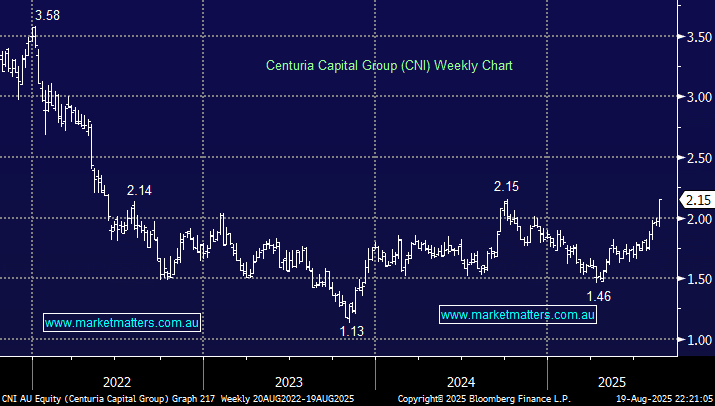

We touched on the CNI result in yesterday afternoon’s The Match Out report, however, it’s worth spending a bit more time on it this morning, given we think this could be a turning point for a position that has required some patience.

Yesterday’s FY25 result showed the benefits of a diversified model and an ability to pivot into higher-growth areas. Operating EPS came in at 12.2c, above guidance, while distributions also edged higher. Importantly, assets under management pushed through $20b, helped by growth in real estate finance and the newer ResetData arm.

The standout here is Centuria’s ability to recycle capital smartly – selling mature assets and redeploying into higher-return areas. The $194m realised from asset sales has gone into healthcare, real estate credit (via Centuria Bass), and AI/data infrastructure (ResetData). ResetData in particular is shaping up as a genuine growth engine, with its sovereign AI facility now live and expected to contribute meaningfully in FY26.

On the traditional side of the business, CNI remains active. They picked up the Logan Super Centre for $115m (with an expected 8% distribution yield), and flagged plans to launch new listed REITs when conditions allow. At the same time, Centuria Bass continues to grow quickly, with real estate finance AUM up over 20% in the half.

- Centuria is doing exactly what you want from a capital-light asset manager – clipping steady fees from a growing AUM base while rotating into the themes of tomorrow. Distributions are edging higher, growth engines like ResetData and Bass are firing, and management has a $1b acquisition pipeline ready to go: MM is long CNI in our Active Income and Emerging Companies Portfolios.

Conditions in commercial property do remain patchy, but it appears to MM that yesterday’s update drew a line in the sand, where CNI has moved from preservation mode, back into growth mode, a theme we touched on in our last note here a few weeks ago. We remain positive on the stock, with its mix of income and growth optionality stacking up well in the current market.