Can you explain your CNI purchase, plus current thoughts towards VUK

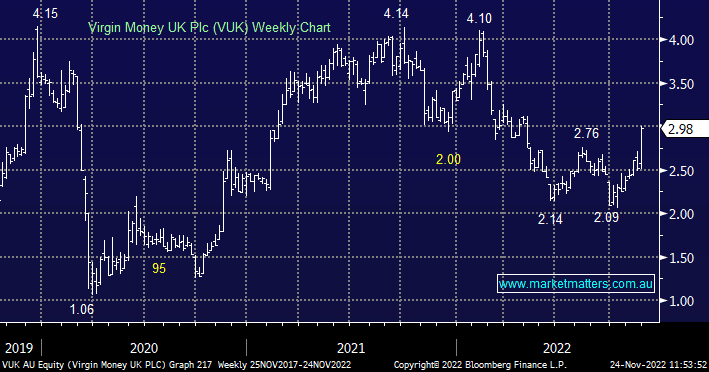

Can you expand on your thinking behind the recent purchase of CNI in the Emerging Markets portfolio. I was thinking that with the future of interest rates still unclear & the value of their property assets likely to decline at next valuation perhaps it is best to steer clear of these and possibly most/all real estate stocks at the moment. Also can I have your thoughts on VUK please following their good results this week. Do you see much further upside in the stock? Thank you