Centuria (CNI) made headlines this week, shelling out $216m for the Port Adelaide Distribution Centre—a major logistics and warehouse hub benefitting from the AUKUS naval shipbuilding program. This is SA’s largest ever industrial property deal, acquired at what CNI calls a ~70% discount to replacement cost.

The asset has some solid tenants—Visy Logistics, Ameropa Australia, Toll Transport, and Spendless Shoes—and will sit in a new single-asset fund, the Centuria Port Adelaide Industrial Fund (CPAIF). The fund has a five-year term with forecast distributions of 7.50% in FY26 and 8.50% in FY27, paid monthly. CNI will look to raise $116m from investors in September, open to both retail and wholesale buyers.

For CNI, this is an important deal, lifting its industrial platform to $6bn and demonstrating confidence in its ability to raise money again—a key driver of growth for the manager. As we touch on with UBS in another piece this morning, rising asset prices drive FUM growth, which drives fee growth. Momentum matters, and this transaction shows early signs of it returning for CNI.

Interest rates cut both ways for CNI. Yes, they carry debt, and higher rates hurt (they hedge less than peers). More importantly, higher yield cash accounts compete for investor capital—why take property risk when you can get 5% in a term deposit? But when rates fall, the pool of investors seeking yield grows, and property funds with monthly distributions backed by tangible assets suddenly look significantly more appealing.

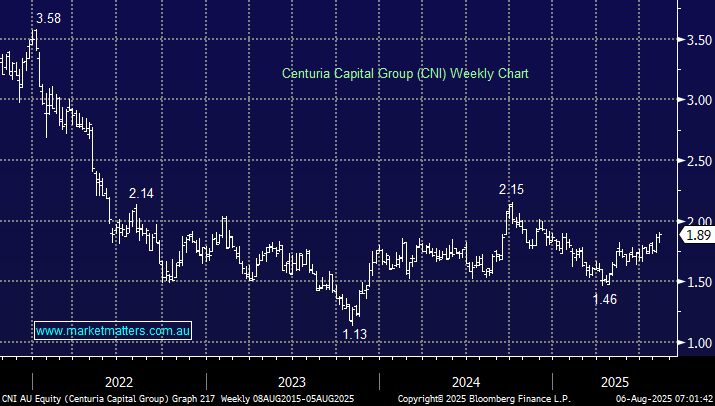

- This deal gives CNI a solid start to FY26 after a quiet few years that capped earnings and the share price.

CNI trades on ~14x Est earnings with a forecast yield of 5.8%, and if the fundraising machine kicks back into gear, there’s upside in both earnings and yield. We hold CNI in the Income and Emerging Companies Portfolios, targeting $2.50.