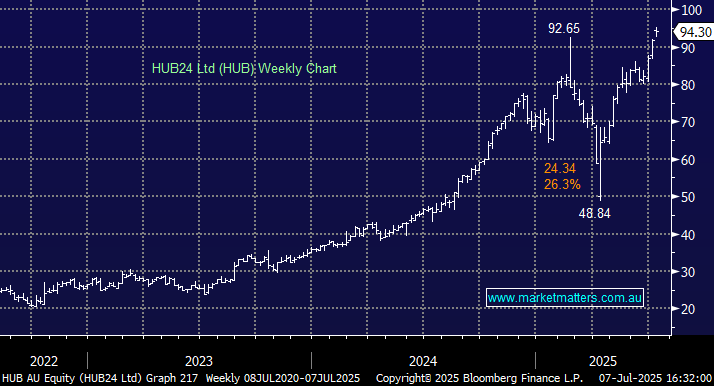

HUB has a strong re-rate in share price following the Liberation Day sell-off. Having increased our weighting to a 5% target in the market malaise, we are now trimming back a 4% portfolio target.

CSL is down 18% over the past year, hit by a confluence of market concerns. We are now attracted to it’s valuation (22x) relative to it’s likely earnings growth (~14%). We are starting with a smaller weighting given some risks around upcoming results. We will likely add to the position in time.