- Markets @ Midday: Listen here at lunchtime or find all Market Matters Podcasts on Spotify.

The ASX was lower on Thursday, with a firmer Aussie dollar and rising rate expectations combining to pressure risk assets. The main drag came from some pockets of the resource sector, particularly rare earths, after reports suggested the Trump administration may back away from a proposed price floor mechanism, a policy support that had been a key pillar behind the sector’s rerating since mid-2025.

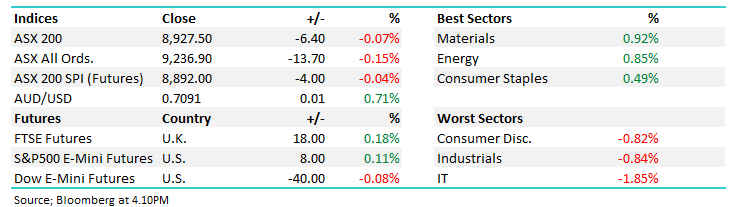

- The ASX200 fell -6pts/-0.07% to close at 8927.

- Materials (+0.92%) and Energy(+0.85%) and Staples (+0.49%)

- Technology (-1.85%), Industrials (-0.84%) and Consumer Discretionary (-0.82%) weighed.

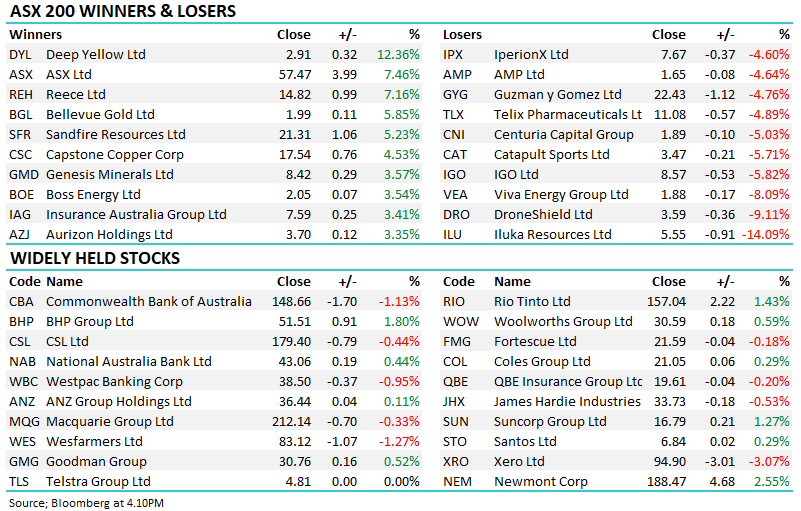

- Lynas Rare Earths (LYC) -4% fell, so did Iluka Resources (ILU) -13.6% after they also flagged a $565m pre-tax hit for the year to Dec 31 (separate issue, but it poured fuel on the fire)

- Gold again pushed into record territory, printing above ~US$5,500/oz. While we’re not seeing “everything gold” bid indiscriminately, Northern Star (NST) +2.7%, Evolution Mining (EVN) +2.3% & Newmont (NEM) +2.2%

- With markets leaning toward a possible RBA hike next week, investors rotated away from the typical rate-sensitive cohort, retailers and higher-multiple tech felt the pinch. JB Hi-Fi (JBH) -1.8%, Harvey Norman (HVN) -1% & WiseTech Global (WTC) -2.1%.

- Energy bucked the tape, helped by both coal and uranium. Uranium pushed back through US$100/lb for the first time in two years, supporting Paladin (PDN) +1.4%, Deep Yellow (DYL) +12.4%, and NexGen (NXG) +4.5%.

- Whitehaven Coal (WHC) +3.1% after a stronger Dec-Q update, citing better production/sales, improving met coal pricing and lower unit costs.

- Appen (APX) +30.1% rallied after a strong quarterly update: 4Q revenue $73.4m, +10% YoY, +33% QoQ

- IGO Ltd (IGO) -6.1% fell despite higher lithium production and improved pricing in the quarter, the market remains wary of the “multi-asset lithium” model and cost pressures across the chain.

- AMP –4.9% updated its cost allocation and cost-to-income methodology ahead of FY25 results (Feb 12). Even if the end-state is sensible, the market often sells first when reporting complexity rises.

- Mineral Resources (MIN) −4.1% opened sharply higher but gave back the early gains and some, as it upgraded lithium volume guidance, though the market cautious around margins with cost guidance steady.

- Qube Holdings (QUB) +0.3% edged higher, as Macquarie Asset Management extended its exclusivity period in the group’s strategic review process

- The AUD pushed to a fresh three-year high (~US70.4c)

- Gold was up ~$128/oz, trading at US$5544/oz around our close

- Iron ore lifted ~+1.5% to around US$104.7/t, supported by a sharp bounce in Chinese property stocks and hopes of further easing measures.

- Asian markets were mixed, with China flat, Hong Kong +0.40% higher and Japan down –0.50%.

- US futures are trading midly higher

- Blackstone (BX US) & Apple (AAPL US) reports tonight in the US