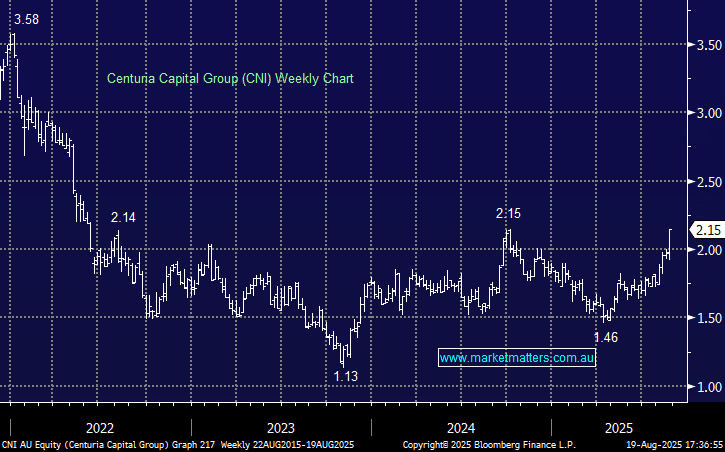

CNI +9.97%: Beats across the board for the property fund manager today, with slightly stronger earnings in FY25, and slightly higher than expected dividend, and guidance implies that momentum continues to build.

- Revenue A$309.4 million, +6% y/y

- Operating EPS A$0.122 vs. A$0.117 y/y

- Final distribution per security A$0.0520 vs. A$0.05 y/y

- Assets under management A$20.6 billion

They expect distributions of A$0.104 in FY26 on operating EPS of $0.134, equating to growth of 9% y/y, which is good for the multiple they are trading on.