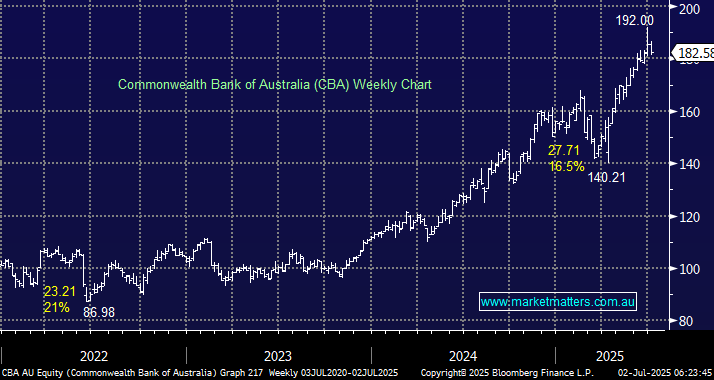

This may well be an unpopular call, but we feel uncomfortable that new members may be buying CBA, or investors adding funds to Market Matters Invest are increasing their exposure to the world’s most expensive bank, trading on what we believe is a very stretched valuation. While there is no choice for ETF investors buying the ASX 200 (with $11.50 of every $100 invested being allocated to CBA), as stock pickers, we can make a bold call like this. We’ve considered many of the arguments for holding our position, and there has been plenty of internal discussion about not fighting the tape, but we ultimately believe that the weight of probability now favours a sell.

Because CBA is such a well-loved stock, and the position is showing a profit of ~250%, it would be easy to simply put it in the bottom drawer and retain exposure, though that is not the MM style. We made a similar call recently in a much-loved stock of MM’s by selling Xero (XRO), and as we look ahead into FY26, we believe there are better uses for this capital.

- We are now looking to sell CBA in the Income Portfolio (que the jeers!)