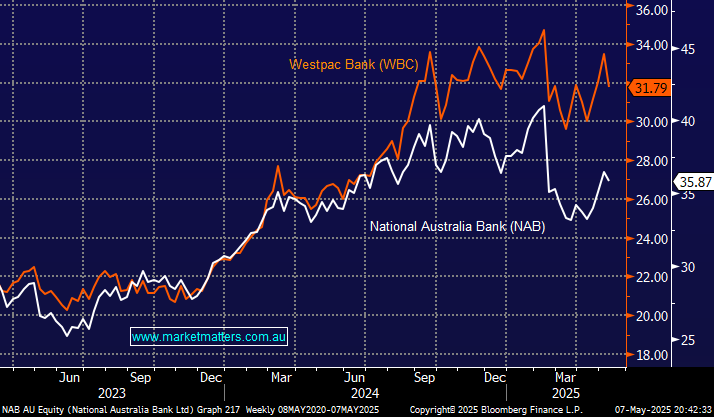

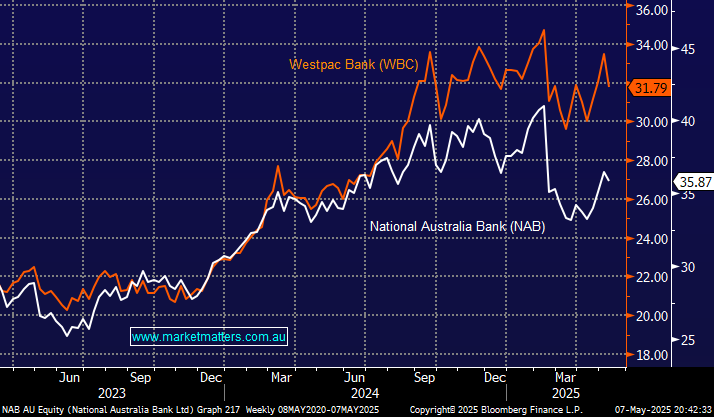

Two of the “Big Four” banks have come out with very different results this week:

- WBC delivered an okay result, but a headline profit miss and slight net interest margin (NIM) contraction saw selling emerge.

- NAB delivered a solid 1H FY25 result, beating cash earnings expectations by 2.9%, driven primarily by a lower-than-expected credit impairment charge.

Both banks had rallied strongly into the numbers, but WBC has since fallen $2.44 from this month’s high, while NAB made fresh May highs on Wednesday after the result before drifting lower. We now ask ourselves whether NAB will address some of its underperformance over the last six months. NAB will trade ex-div 85c fully franked on the 12th and WBC 76c fully franked today, providing the opportunity to take the WBC dividend and switch into NAB, an interesting option for yield and franking-hungry investors. From a valuation and yield perspective, there’s not much between the two.

- We can see NAB outperforming WBC for a few sessions after WBC trades ex-div. today: We hold WBC in our Active Growth Portfolio.

NB: ANZ reported 1H earnings this morning that were mildly ahead of expectations, while the dividend of 83cps was flat YoY and inline with consensus.