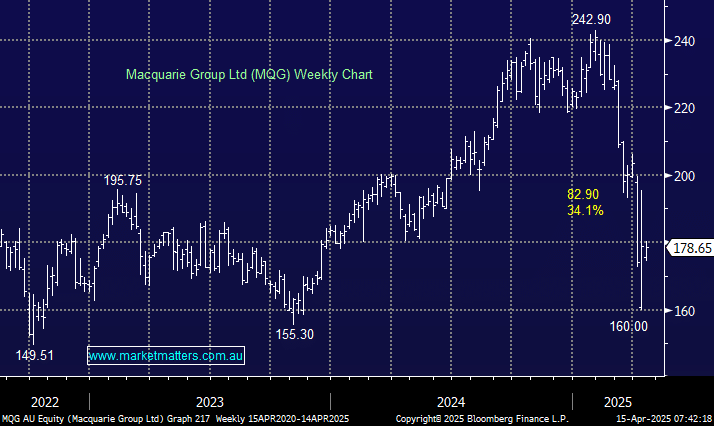

MQG has been “smacked” well over 30% in the last few months, not helped by the uncertainty created by over a third of its revenue coming from the US. However, it’s not a business in the eye of the tariffs, although it is exposed to a downturn in the underlying US economy. MQG may miss the short-term revenue from M&A, capital raisings, and IPOs, but as we have seen from its US peers, the uptick in trading revenue has the potential to plug that hole. MQG is set to report and trade ex-dividend in May.

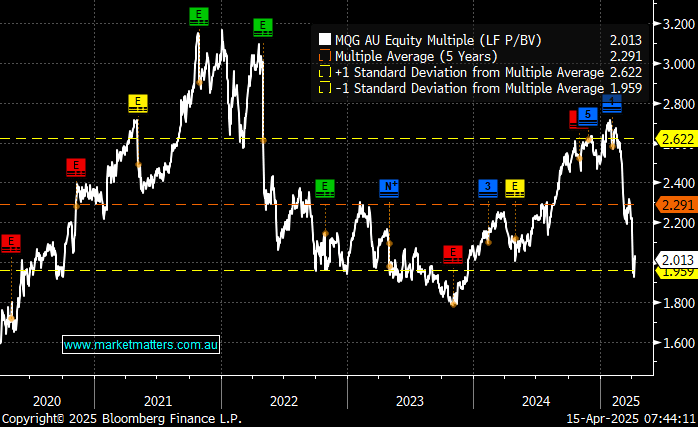

- MQG continues to trade well below its average 5-year valuation, providing solid risk/reward as the US banks continue to deliver.

- We like MQG and are considering increasing our position from 5% to 6%: MM owns MQG in its Active Growth Portfolio.