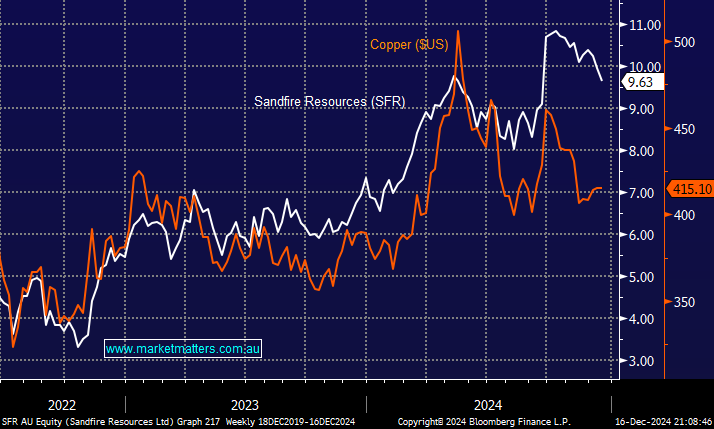

Copper (Cu) producer SFR fell by 3.3% on Monday to its lowest level in 14 weeks after being downgraded by Morgan Stanley to underweight (sell equivalent) with a $9 PT, the most bearish on the street and a big deviation from Barrenjoey, who rates it a buy-equivalent and $12 PT. Our Active Growth Portfolio trimmed its SFR position in late October around the $10.40 level; it feels like we should have been more heavy-handed at this point. Our concern was and still is that SFR has/is trading well above the copper price compared to recent years; hence, we’re not planning on topping up at this point.

- We remain bullish toward Cu and SFR in the medium term, initially targeting the $12 area for SFR.