IGO is the lowest-cost lithium (Li) producer on the ASX. In the September quarter of FY24, its cash cost of producing lithium spodumene concentrate was ~A$277 per tonne and they are very leveraged to prices as they continue to ramp up Greenbushes. They have been in spending mode in recent years while also dealing with their troubled Nickel assets, however, we think there are now reasons to become at least less negative on IGO around $5.

On the other hand, South32 (S32) enjoyed disruptions in supplies of bauxite from Guinea and Brazil and output suspensions in Australia which has contributed to a huge surge in alumina prices which in turn has put upward pressure on Aluminium prices (Alumina is turned into aluminium through a smelting process).

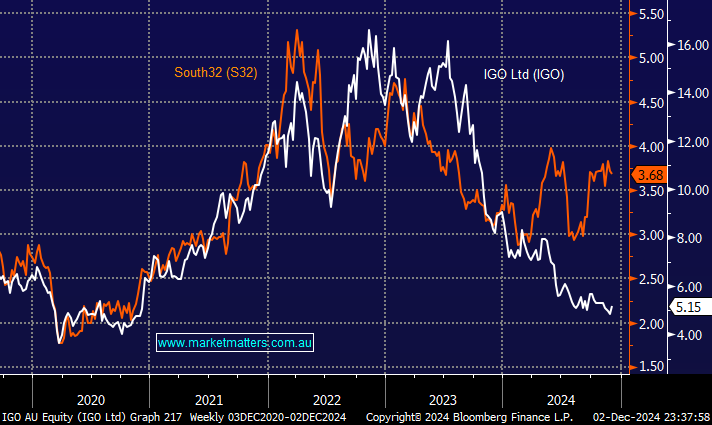

The relative performances has us weighing up whether the outperformance by S32 against IGO is maturing.

- We like S32 and IGO into 2025, but the latter will likely outperform if lithium has reached its nadir – IGO is in our Active Growth portfolio’s Hitlist.