XRO +5.85%: A solid 1H25 result from the Accounting platform today, effectively showing their transformation towards more equitably balancing profit and growth is working;

- Operating revenue for the half of $996 million, up 25% and a whisker ahead of expectations.

- Operating expense to revenue ratio of 71.2%, compared favourably to prior guidance ~73%

- This underpinned a 51% increase in 1H25 EBITDA to $312 million, a 6% beat to consensus.

- Free cash flow increasing to $208.7 million and a free cash flow margin of 21.0%, improving from 13.3% in the prior period.

More subscribers are spending more money with Xero, in part to fee increases which has slowed growth in subscriber numbers to some degree, but it hasn’t translated into churn of existing. Net subscriber adds in the period were a touch ahead of Market Matters at 401k, though that missed forecasts by about 10%. Total subs of 4.2m were up 6% YoY. They guided to operating expenditure (opex) of 73% of revenue but product and development spend will be flat for the year and headcount has only increased +3%, so there is a good chance they may beat this number in the 2H as they did in the 1H.

Xero hit ~44% in the ‘Rule of 40’ metric, which is often a measure used in SaaS companies as a measure of good, portable growth rather than growth for growths sake. The rule states that a company’s combined growth rate plus profit margin should reach or exceed 40% at all times.

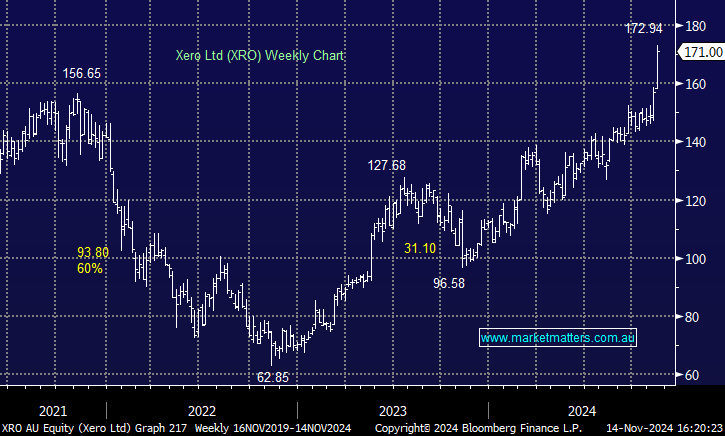

- A good result, a good bounce in the stock and we continue to back the execution of CEO Sukhinder Cassidy who joined XRO in Feb 2023, with the share price more than doubling over that time.