CNI +1.82% with its operating profit met analyst expectations, which was reflected by the quiet day after the result.

- Revenue of $327mn was down -12% yoy and Net income of $102.2mn, -3.6% yoy.

- Operating profit of $94.7mn, down -18% yoy, and slightly below $95.6mn estimates.

- Operating EPS 11.7c v 14.5c yoy and estimates of 12c.

- Final distributions of 5c v 5.8c yoy.

- Assets under management of $21.1bn are up +0.55 yoy.

- FY25 forecasts EPS of 12c came in below estimates f 13c.

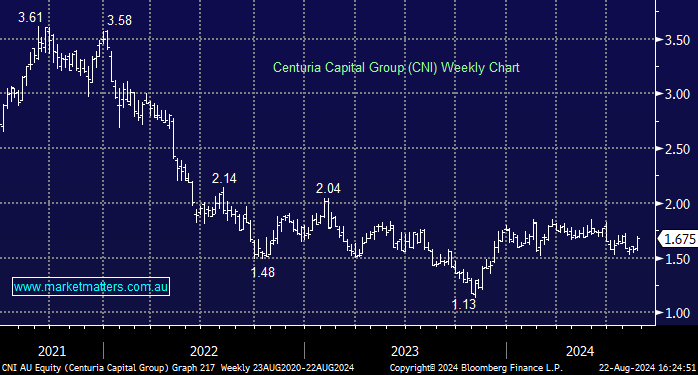

This is a steady result, but as we saw with Charter Hall (CHC) on Wednesday, expectations are low, and we’re still looking for a test of $2 over the coming year—MM holds CNI in our Active Income Portfolio.