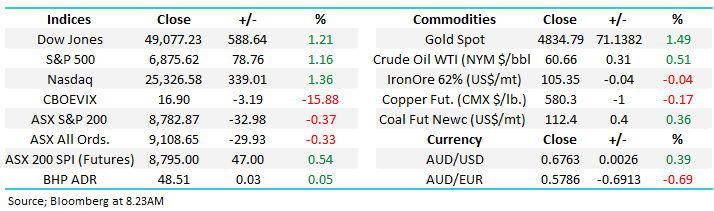

Overnight saw mixed sessions in Europe and across US indices; the UK FTSE edged up +0.3% while the EURO STOXX 50 fell 1.1% as investors anticipate a period of growth-friendly policies and political stability in the U.K. under the newly elected Labour government. Conversely, France continues to deliver uncertainty. In the US, the rotation out of high-flying mega-cap tech stocks into the more rate-sensitive names continued, with the Dow rallying +0.6% while the NASDAQ closed down -2.9%. The Russell 2000 (small cap) index slipped 0.7%, ending its five-day winning streak, which had delivered an advance close to 12% as the market rally broadened out on rate cut expectations.