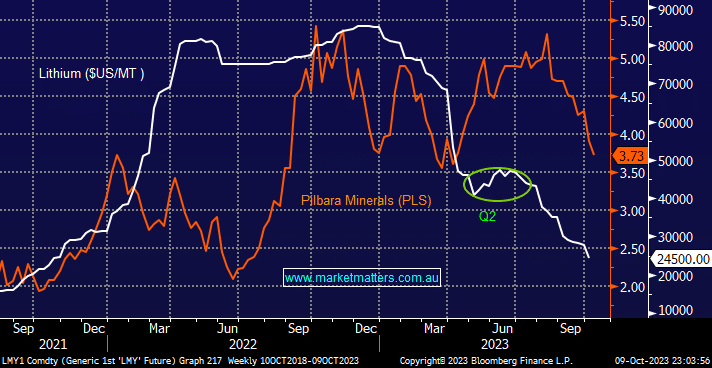

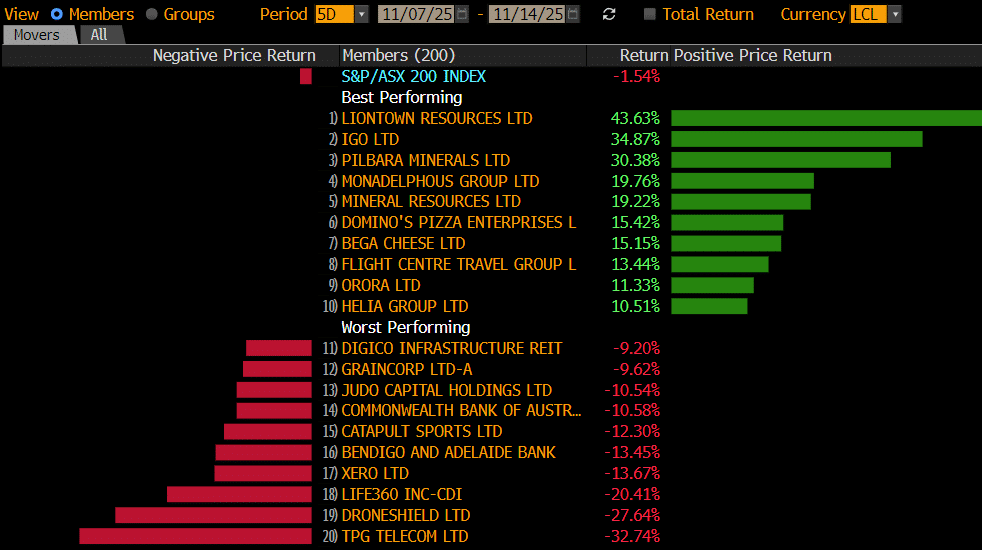

PLS keeps on slipping lower, it’s now corrected over 31% from its July high as both the lithium price and related stocks continue to struggle. We believe value is starting to present itself, especially for quality stocks like PLS, which hold $3.3bn in cash and continued strong FCF (Free cash flow) generation, we could see an upsized return to shareholders in the near term. The major issue for the stock going forward is costs and the plummeting lithium price. An alternative to PLS that MM is also considering is Mineral Resources (MIN), i.e. topping up our existing position.

- We are considering increasing our exposure to lithium stocks into the current weakness, but we’re conscious that the last time lithium was sub $US25,000, PLS was trading under $3.