Energy infrastructure company APA is currently in a trading halt as they raise a total of $750mn at $8.50, a 8.2% discount to its last trade. $675m was placed very quickly with institutions yesterday while there is a share purchase plan available for retail investors with details sent shortly.

We believe the market has been concerned for a while around the potential for a pending raise to buy the Alinta Power assets which suggests an opportunity might be in the offing – APA are paying $1.8bn for the assets, slightly below the expected price tag of $2bn. We are positive about APA’s East Coast pipeline network over FY24-26 and while being conscious that the VIC Gov ban on new gas connections will have little near-term impact it must be considered longer-term while we could see renewed regulatory focus on APA’s QLD to NSW/VIC gas pipeline route.

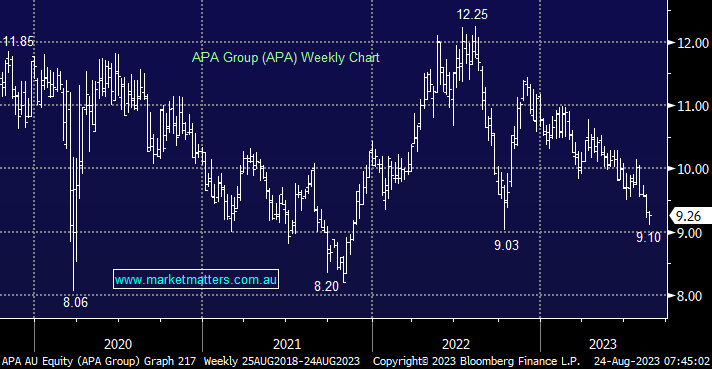

- Despite some near-term uncertainly we discussed recently (here), we believe the likely share price decline from this raise, now presents a good entry point into APA ~$9.00, with an estimated yield over the coming year now likely to be above 6%.

- We already own APA in our Active Income Portfolio, and we intend to increase our position.