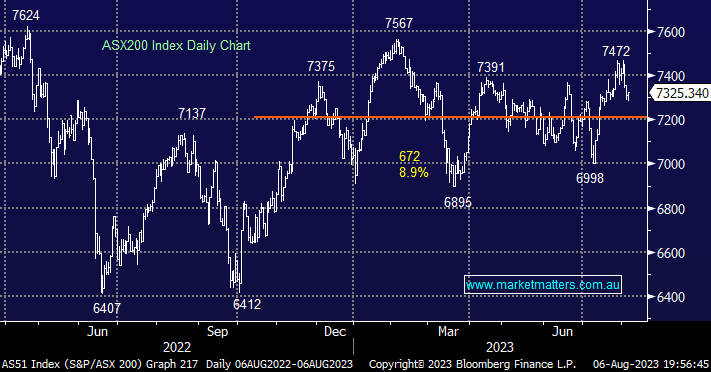

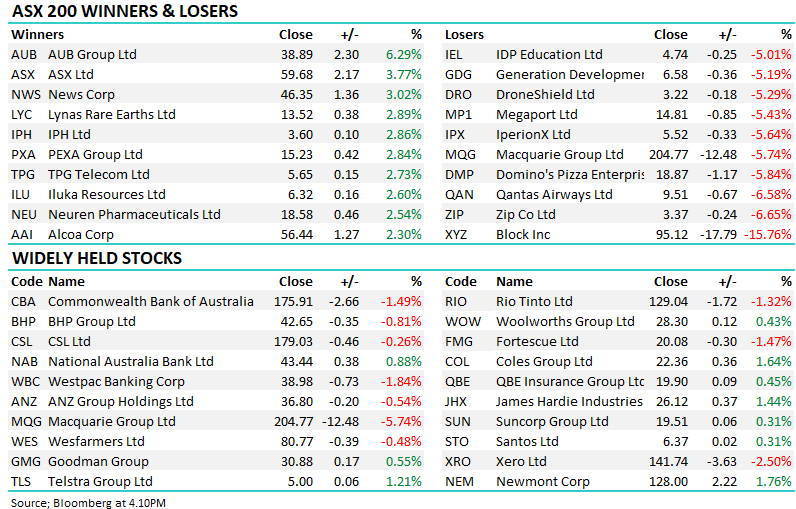

The ASX200 slipped -1% last week with the yield-sensitive sectors dragging the market lower while only the Consumer Discretionary Sector closed higher. However, as reporting season got underway investors’ attention switched away from the macro news towards action on the individual stock level – this week we will see the likes of James Hardie (JHX), Dexus (DXS), Commonwealth Bank (CBA), QBE Insurance (QBE), Newcrest (NCM) and REA Group (REA) face the music.

Market Matters Reporting Calendar: Click Here

- The SPI Futures are pointing to a dip of -0.15% this morning following a weak close on Wall Street and a ~20c dip by BHP in the US.

- No change, MM believes this year will be dominated by moves on the stock/sector level as opposed to the underlying index – especially during reporting season!

US indices slipped lower last week weighed down by the US ratings downgrade, earning misses from stalwart Apple Inc (AAPL US), and what felt like some general profit-taking across the high-flying tech sector – a move we have been looking for and still believe will represent a good buying opportunity through the 2H. To quantify our target “buy areas” for a couple of well known stocks: Microsoft (MSFT US), Alphabet (GOOGL US), and Tesla (TSLA US) are all 5-10% lower suggesting the big end of town will experience some further meaningful profit-taking after surging higher in 2023.

- We remain bullish towards equities medium term, but we believe the market is now in the midst of our targeted tech-led pullback.

European equities rallied early in the week only to reverse lower under the weight of external influences but at this stage, we see no reason to fight the uptrend albeit “3 steps forward 2 steps back in nature”

- The UK FTSE shrugged off last week’s BOE rate hike and US debt downgrade, while the EURO STOXX posted 15-year highs early in the week.