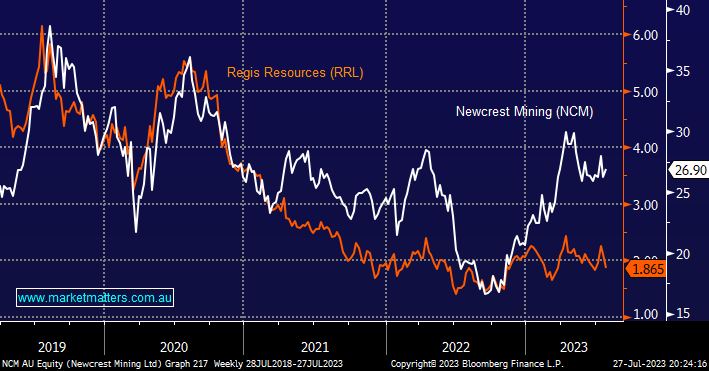

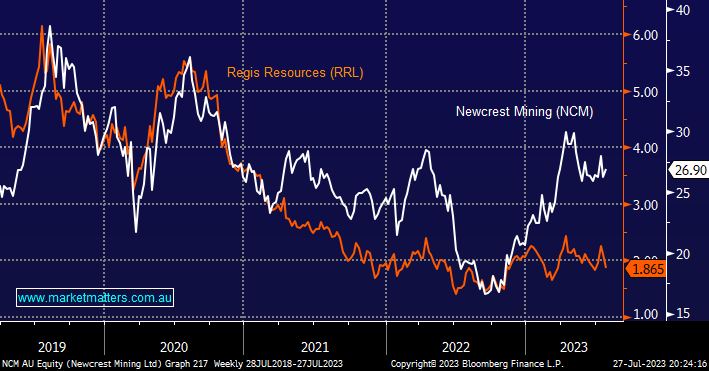

MM is looking to switch part of our gold exposure from NCM hence when we see fellow gold miner RRL fall -10.8% in one day, while NCM rallies +0.6%, it catches our attention especially when yesterday’s move followed the trend of 2023 which has seen NCM advance +31% while RRL is only up 1.5%.

- RRL fell the most in 18 months on output and cost guidance i.e. output came in ~5.5% below April’s guidance – the stock tumbled -10.8%.

- The outlook for costs was increased by ~18%, a poor company update where the share price move appeared justified.

One trend that was noticeable intraday yesterday and has been common through 2023 is the “weak getting weaker and the strong stronger”, following yesterday’s report RRL doesn’t screen as cheap to MM.