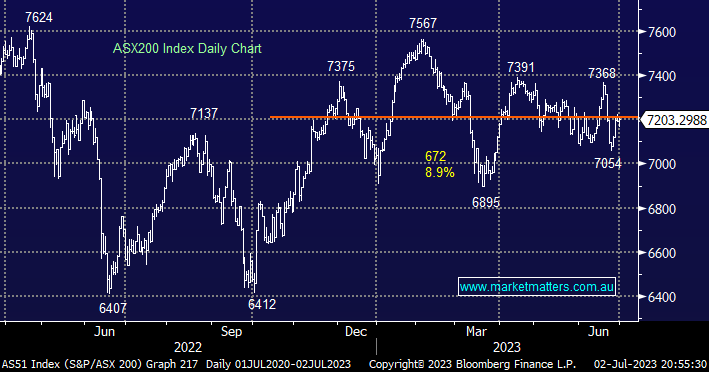

Last week saw the ASX200 rallied solidly into the EOFY with the Tech, Real Estate and Consumer Discretionary Sectors leading the gains, following Wall Street moves on Friday night this morning is likely to be much of the same from a relative performance perspective.

- The SPI Futures are pointing to a +0.4% rally early this morning, with tech again likely to lead the market higher.

The tech based NASDAQ rallied another +1.6% on Friday night as Apple Inc (AAPL US) again posted fresh all-time highs to become the first listed $US 3trillion company, we see ongoing gains in a “3 steps forward 2 back” manner as the impressive rally over the last 6 months slowly but steadily matures.

- No change, we are keen buyers into weakness, ideally of a similar magnitude to the February-March pullback.

European stocks have advanced to be less than 4% below their all-time highs with upside momentum strong even as the geopolitical and macro-economic backdrop remains challenging, we are reticent to chase the current strength but it also feels too early to fade these gains.

- The EURO STOXX 50 is set to make fresh 15-year highs this evening with no sell signals in sight.