The ASX200 slipped marginally lower last week largely ignoring a surprise rate hike by both the RBA and Bank of Canada however even while the market edged just -0.3% lower under the hood things were far more interesting following the aggressive moves by central banks plus their ongoing hawkish rhetoric, this pivoted investors sentiment on the stock and sector level, at least for a few days:

- Tech has been the standout performer so far in 2023 but last week some cracks appeared in the growth space on faltering optimism around peaking rates.

- The underlying index continues to look comfortable at current levels whatever the news, hence at MM we continue to believe investors should continue to focus on stocks/sectors as opposed to the index.

Following last night’s strength across US Tech which saw the NASDAQ advance +1.76% compared to the Dow which gained just +0.56% we’re not surprisingly expecting the buyers to return to the growth stocks today, especially after oil tumbled -3.65% taking the US Energy Sector down -1% – however, we do believe the last few sessions is showing that some realignment in the value and growth sectors is starting.

- The SPI Futures are calling the ASX200 to open flat this morning following the last 2 sessions in the US.

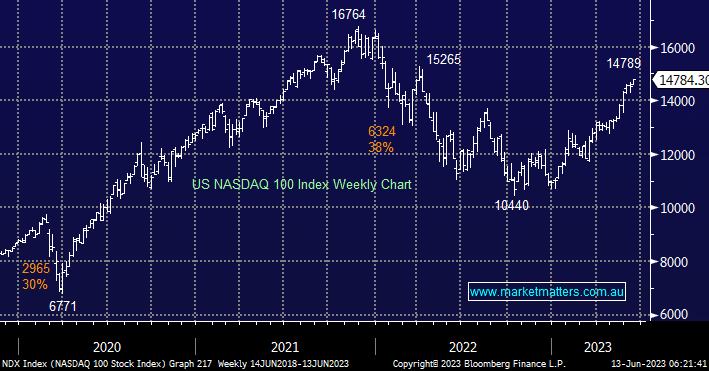

The NASDAQ made fresh 1-year highs last night as heavyweight Apple Inc (AAPL US) again posted all-time highs, hardly the bear market so many pundits keep forecasting. i.e. the strong keep getting stronger. In our opinion the likes of NVIDIA (NVDA US) are now likely to have a rest hence we can see the Tech Sector consolidating recent gains into July/August but we see no reason to not favour buying dips and investing with the trend.

- We are sticking to our more bullish stance toward tech but our view is still the “easy money” is behind us.

- We are looking for a choppy appreciation up towards the 15,500 area over the coming months.

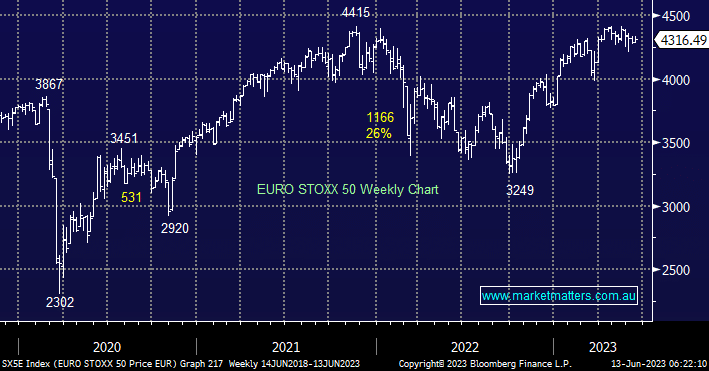

Many pundits keep talking equities down but when we stand back many major markets are actually back in bull Market territory following deep pullbacks as interest rates surged along with inflation through 2021/2. The European market has been at the centre of economic and political turmoil as war rages in Ukraine but stocks are less than 2.5% below fresh decade highs implying one piece of positive news and we could easily see a bullish breakout on the upside.

- Our preferred scenario is the EURO STOXX 50 will initially test the 4500 area, or +5% higher.