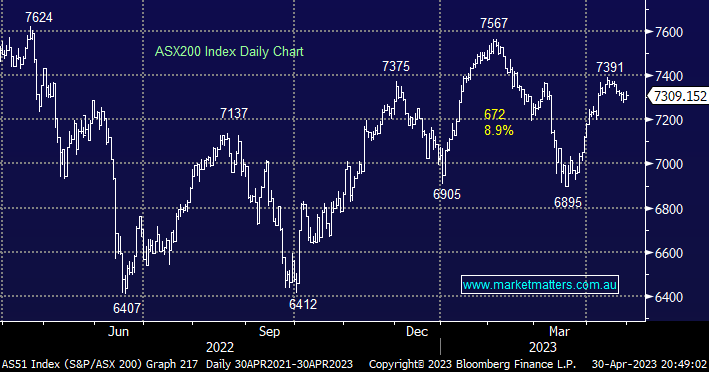

The ASX200 continues to feel tired and although it’s set to rally back up towards last month’s 2023 highs in early May we don’t believe its a “risk on” advance that should be chased in earnest, we continue to believe that value will primarily be added to portfolios through stock & sector rotation.

- No change, we believe this year will be about “buy weakness and sell strength, with an emphasis on the latter” while stock & sector rotation will provide plenty of opportunities under the hood.

US stocks rallied strongly on Friday night as the tech-based NASDAQ made fresh 8-month highs as earnings continue to deliver positive/relief surprises leading to huge dollar inflows across the sector – last month saw $1.8bn poured into US tech, the highest amount in 6 months. After reading this month’s Bank of America Fund Manager Survey it’s starting to feel like some capitulation is unfolding as fund managers’ performance is threatened by excessive cash holdings and an overall negative outlook.

- We continue to target the 13,700 for the NASDAQ, now only 3-4% away.

European stocks slipped slightly lower last week, as is commonly the case more in line with our own index as opposed to the tech-dominated US market. However, we are still targeting a test of new post-GFC highs in the coming weeks, still only 1.3% away.

- No change, the EURO STOXX 50 remains well positioned to make fresh post-COVID highs with its all-time peak also a distinct possibility.