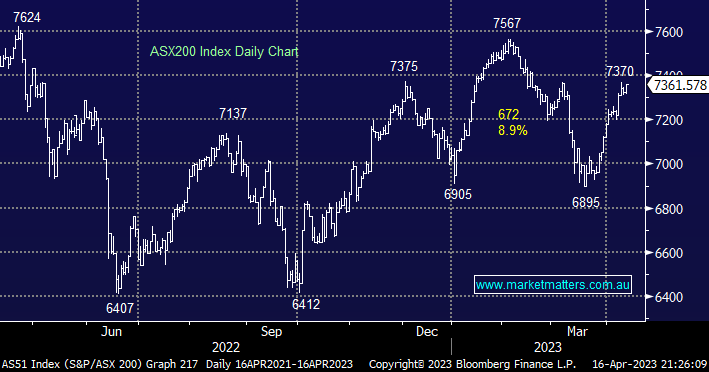

The ASX200 rallied strongly in the shortened week as the path of least resistance remains on the upside with investors continuing to be positioned too conservatively. Analysts are forecasting an ugly earnings season with deteriorating profits and weakening guidance with no major turnaround expected this year however with the bears so prominent the potential for upside surprises increases as we saw on Friday with the banks.

- The local market is set to open slightly higher this morning with strength in the banks expected to trump weakness elsewhere e.g. BHP Group (BHP) fell ~1% in the US.

- With the ASX200 set to open within 3.5% of its all-time high this morning we must remain skewed towards a positive outlook short-term.

US stocks fell into the weekend but with the S&P500 reclaiming over 70% of the losses post the Fed comments, we believe the market internals remain strong with plenty of buyers of dips on any bad news. While reporting season will be a challenge to the US market, especially individual companies, expectations are still skewed very much to the downside so stocks are poised to rally when results are “not too bad”.

- No change, in our opinion US stocks have weathered the banking storm and the S&P500 can rally towards 4200-4300 resistance over the coming weeks.

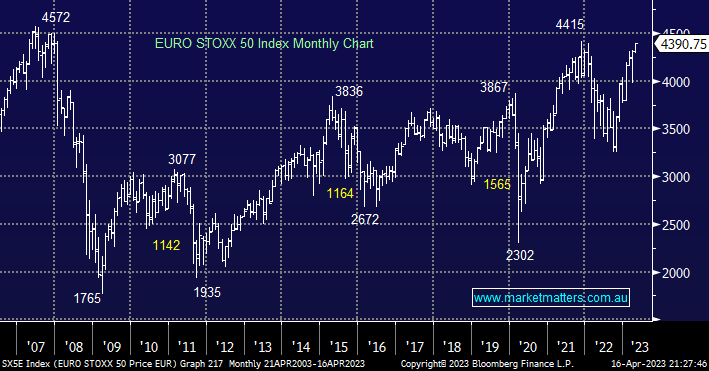

European stocks extended their recent strength after the Easter break which remains amazing considering the macro and political backdrop across the region. The index is now ~0.5% below its post-COVID high and with value stocks gaining strength higher prices feel almost inevitable as underweight fund managers get increasingly squeezed in the rally.

- The EURO STOXX 50 remains well positioned to make fresh post-COVID highs with its all-time level also a distinct possibility after markets absorbed the uncertainty from its Banking Sector.